KION shares

Robust upward trend in the equity markets

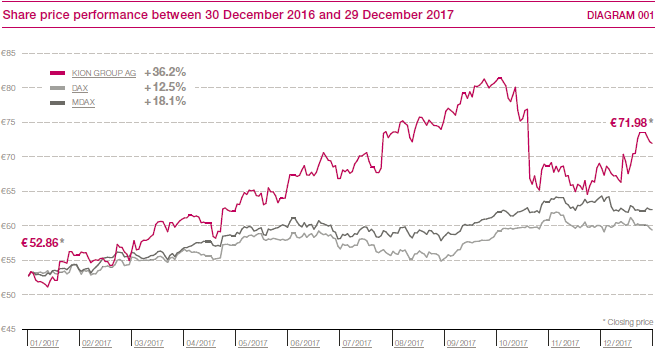

With volatility at a low level, stock market prices soared and indices reached record heights in 2017. The DAX closed the year at 12,918 points – not far off its high for the year – and gained 12.5 per cent, while the MDAX added 18.1 per cent. This uptrend was supported, firstly, by expansionary central bank policy in the eurozone, which kept deposit rates and bond yields at rock-bottom levels and thus made equities more attractive. Secondly, stock market prices were driven up by the healthy economy, companies’ rising profits and positive sentiment indicators. Despite political uncertainties created by the United Kingdom’s approaching exit from the European Union, the elections in France and the Netherlands, the quest for Catalonian independence and the dispute with North Korea, the stock markets proved robust. The failure of the exploratory talks on the formation of a coalition following Germany’s general election also only halted their upward progress temporarily.

KION shares outperform benchmark despite correction

The price of KION shares rose sharply and steadily in the first three quarters of 2017 and reached an all-time high of €81.40 on 2 October 2017. After the outlook for the year was adjusted in October 2017 due to the Supply Chain Solutions segment not performing as expected, there was a marked price correction. The share price subsequently remained flat. Despite some of the previous gains being negated, the KION share price rose by 36.2 per cent to €71.98 over the course of the year, thereby outperforming its benchmark DAX and MDAX indices considerable.

On 11 May 2017, the Annual General Meeting voted in favour of distributing a dividend of €0.80 per share for 2016. As in the previous year, when a dividend of €0.77 was paid, the dividend payout ratio was 35 per cent. The total dividend payout, however, increased by 14.3 per cent to €86.9 million mainly owing to the capital increase carried out the year before. > DIAGRAM 001

KION GROUP AG’s market capitalisation was €8.5 billion at the end of 2017. Of this total, 56.6 per cent or €4.8 billion was attributable to shares in free float. The average daily Xetra trading volume in 2017 was 332 thousand shares or €22.0 million, which was again up considerably on the prior year. > TABLE 001

Basic information on KION shares |

001 |

ISIN |

DE000KGX8881 |

WKN |

KGX888 |

Bloomberg |

KGX:GR |

Reuters |

KGX.DE |

Share type |

No-par-value shares |

Index |

MDAX, MSCI World, STOXX Europe 600, FTSE EuroMid |

Annual General Meeting approves further financing for growth

KION GROUP AG’s Annual General Meeting on 11 May 2017, at which 82.2 per cent of the voting share capital was represented, approved the creation of new authorised capital of up to €10,879,000.00 or 10 per cent of the share capital. The Executive Board has thus been authorised, subject to the consent of the Supervisory Board, to issue additional shares on this basis up to and including 10 May 2022, excluding shareholders’ subscription rights.

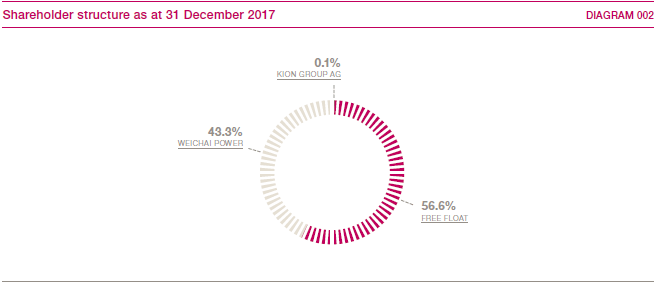

Most of this authorised capital was used on 22 May 2017 to refinance a large part of the remaining bridge loan (AFA) that had been granted for the purchase of Dematic. By issuing 9.3 million new shares – equating to 8.55 per cent of the share capital – at a placement price of €64.83, the KION Group generated gross proceeds of €602.9 million. Between 10 and 30 October 2017, KION GROUP AG repurchased a total of 60,000 shares (around 0.05 per cent of the share capital) for use in the KION Employee Equity Programme (KEEP). In October 2017, the KION Group employees entitled to participate in KEEP were given the opportunity to buy more KION shares. By 31 December 2017, a total of 36,294 shares had been purchased by staff (31 December 2016: 45,564 shares). The number of shares held in treasury stood at 160,829 as at the reporting date. > DIAGRAM 002

Shareholder structure remains stable

Weichai Power Co. Ltd. purchased 4,023,275 new shares in the context of the capital increase, maintaining its stake in KION GROUP AG at the unchanged level of 43.3 per cent and remaining the biggest single shareholder. At the end of 2017, 56.6 per cent of the Company’s shares were in free float, while KION GROUP AG held 0.1 per cent. The standstill agreement, which remains in force until 28 June 2018, prevents Weichai Power from holding more than 49.9 per cent of the Company’s shares.

KION shares predominantly recommended as a buy

As at 31 December 2017, 21 brokerage houses published reports on the KION Group (31 December 2016: 19). Of this total, twelve analysts recommended KION shares as a buy, eight rated them as neutral and one analyst recommended to sell them. The median target price specified for the shares was €75.00 (31 December 2016: €61.00).

Dividend of €0.99 per share planned

The Executive Board and Supervisory Board of KION GROUP AG will propose a dividend of €0.99 per share to the Annual General Meeting on 9 May 2018. This equates to a dividend payout ratio of around 35 per cent with earnings per share (pro forma) for the year 2017 of 2.91 €. This results in an increase of the dividend per share of 23.8 per cent and an increase in total dividend payout of 34.3 per cent year on year due to the capital increase. The earnings per share of 3.72 € based on the net income was adjusted due to the revaluation of deferred tax liabilities (net) in connection with the corporate income tax rate reduction approved in the US. > TABLE 002

Share data |

002 |

||||

|

|||||

Closing price at the end of 2016 |

€52.86 |

||||

High for 2017 |

€81.40 |

||||

Low for 2017 |

€51.27 |

||||

Closing price at the end of 2017 |

€71.98 |

||||

Market capitalisation at the end of 2017 |

€8,500.1 million |

||||

Performance in 2017 |

36.2% |

||||

Average daily trading volume in 2017 (no. of shares) |

332.0 thousand |

||||

Average daily trading volume in 2017 (€) |

€22.0 million |

||||

Share capital |

€118,090,000 |

||||

Number of shares |

118,090,000 |

||||

Earnings per share for 2017 |

€3.72 |

||||

Earnings per share for 2017 (pro forma)1 |

€2.91 |

||||

Dividend per share for 2017 |

€0.99 |

||||

Dividend payout rate1,2 |

35% |

||||

Total dividend payout2 |

€116.7 million |

||||

Equity ratio as at 31/12/2017 |

28.0% |

||||

Sound borrowing situation, improved credit ratings

To refinance the AFA, a promissory note with an extended maturity profile and a volume of €1,010.0 million was issued in February 2017. The three tranches have maturity periods of five, seven and ten years.

In January 2017, the KION Group received an investment-grade rating for the first time. Fitch Ratings gave the Group a long-term issuer rating of BBB– with a stable outlook, reflecting its improved financial profile, high level of profitability and stable free cash flow. In April 2017, rating agency Standard & Poor’s initially raised its credit rating for the KION Group from BB+ with a negative outlook to BB+ with a stable outlook before upgrading it again, to BB+ with a positive outlook, in September 2017.