KION shares

Significant share price increase in first half of 2017

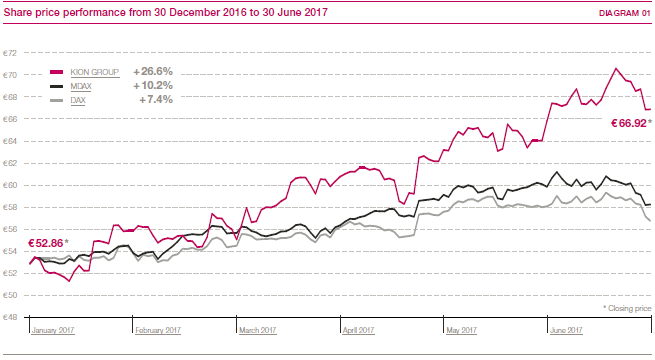

The German equity markets soared in the first half of the year, exhibiting only a low level of volatility. One of the main drivers was the encouraging growth in corporate earnings. The DAX closed on 12,325 points as at 30 June 2017, which was 7.4 per cent higher than at the end of 2016. The MDAX went up by 10.2 per cent over the six-month period.

KION shares significantly outperformed the DAX and MDAX reference indices, particularly in the second quarter. On 21 June 2017, they achieved their highest price of the year so far of €70.64. The share price finished the six-month period at €66.92, a rise of 26.6 per cent (31 December 2016: €52.86). At the end of June, market capitalisation stood at €7.9 billion, of which €4.5 billion was attributable to shares in free float. > DIAGRAM 01

Annual General Meeting approves capital increase

The Annual General Meeting on 11 May 2017, at which 82.2 per cent of the share capital was represented, approved the Supervisory Board and Executive Board’s proposals with a large majority, including a dividend distribution of €0.80 per share, compared with €0.77 last year. The dividend payout ratio was thus unchanged year on year at 35 per cent, while the total dividend payout increased significantly to €86.9 million due to the capital increase in 2016.

The Annual General Meeting also approved the creation of new authorised capital of up to €10,879,000.00 or 10 per cent of the share capital. The Executive Board has thus been authorised, subject to the consent of the Supervisory Board, to issue additional shares on this basis up to and including 10 May 2022. The authorised capital was used on 22 May 2017 to increase the Company’s share capital by 8.55 per cent against cash contributions; the shareholders’ subscription right was excluded.

Stable shareholder structure

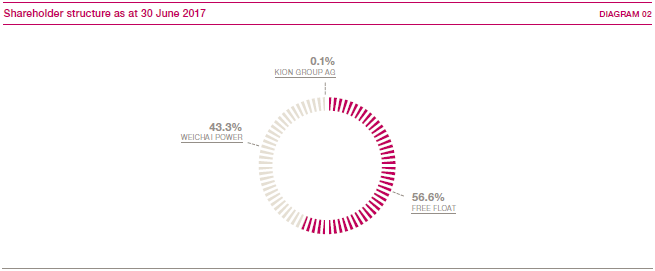

The shareholder structure remained stable in the reporting period. In the context of the capital increase, Weichai Power Co. Ltd. purchased 4,023,275 of the new shares in line with its stake in KION GROUP AG, which remained unchanged at 43.3 per cent. Weichai Power therefore remains the largest single shareholder. KION GROUP AG continued to hold 0.1 per cent of the shares. The free float thus accounted for 56.6 per cent. > DIAGRAM 02

Comprehensive coverage

Nineteen brokerage houses currently publish regular reports on the KION Group. As at 30 June 2017, eleven analysts recommended KION shares as a buy, seven rated them as neutral and one analyst recommended selling them. The median target price specified for the shares was €70.00 at the end of the reporting period. > TABLE 01

Share data |

01 |

||

|

|||

Issuer |

KION GROUP AG |

||

Registered office |

Wiesbaden |

||

Share capital |

€118,090,000; divided into 118,090,000 no-par-value shares |

||

Share class |

No-par-value shares |

||

Stock exchange |

Frankfurt Stock Exchange |

||

Market segment |

Regulated market (Prime Standard) |

||

Index membership |

MDAX, STOXX Europe 600, FTSE EuroMid, MSCI Germany Small Cap |

||

Stock exchange symbol |

KGX |

||

ISIN |

DE000KGX8881 |

||

WKN |

KGX888 |

||

Bloomberg / Reuters |

KGX:GR / KGX.DE |

||

Closing price as at 30/06/2017 |

€66.92 |

||

Performance since beginning of 2017 |

26.6% |

||

Market capitalisation as at 30/06/2017 |

€7,902.6 million |

||

Free float |

56.6% |

||

Earnings per share* |

€1.35 |

||

Improved credit rating

In January, the KION Group received an investment-grade rating for the first time. Fitch Ratings gave the Group a long-term issuer rating of BBB – with a stable outlook, reflecting its improved financial profile, high level of profitability and stable free cash flow. In April, rating agency Standard & Poor’s raised its credit rating for the KION Group from BB + with a negative outlook to BB + with a stable outlook.