We

keep

the

world

moving.

We keep the world moving.

1. Order intake

€4,877.3 million

2. Revenue

€4,577.9 million

3. Adjusted EBIT*

€442.9 million

4. Total R&D spending

€119.7 million

5. Net income (loss)

€178.2 million

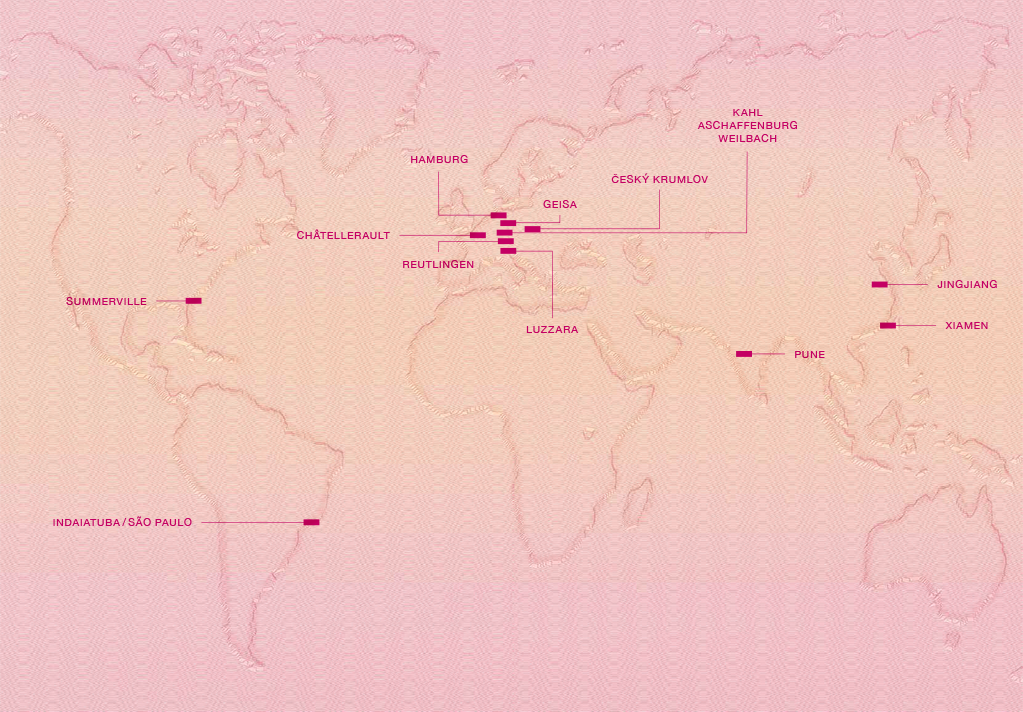

6. Employees

22.669

7. Free cash flow**

€305.9 million

<<KION GROUP AG<<WIESBADEN<<<<<<<<<<

DE000KGX8881<<KGX888<<<<MDAX09.2014<<

* Adjusted for KION acquisition items and one-off items

** Free cash flow is defined as Cash flow from operating activities plus Cash flow used in investing activities.