The amount of the outstanding bonds was reduced by a total of €525.0 million to €450.0 million on 15 April 2014. In detail, this meant that the fixed-rate tranche of the corporate bond issued in 2011, which was due to mature in 2018 and had a volume of €325.0 million, and the floating-rate tranche of the corporate bond issued in 2013, which was due to mature in 2020 and had a volume of €200.0 million, were repaid early in full. Repayment of these bonds, which had been issued before the IPO, was financed by drawdowns from the existing revolving credit facility and an extension to the credit facility of €198.0 million. The fixed-rate (6.75 per cent) tranche of the bond issued in 2013, which has a volume of €450.0 million and a maturity date of 2020, remains in place. On 7 April 2014, Moody’s raised the rating of the KION Group and the bonds from Ba3 to Ba2 with a stable outlook. Then on 15 April 2014, S&P raised its rating for the KION Group from BB– with a positive outlook to BB, still with a positive outlook. >> TABLE 01

|

Share data

|

>>TABLE 01

|

|

|

|

|

Issuer

|

KION GROUP AG

|

|

Registered office

|

Wiesbaden

|

|

Share capital

|

€98,900,000; divided into 98,900,000 no-par-value shares

|

|

Share class

|

No-par-value shares

|

|

Stock exchange

|

Frankfurt Stock Exchange

|

|

Market segment

|

Regulated market (Prime Standard)

|

|

Index

|

SDAX, MSCI Small Cap Germany

|

|

Stock exchange symbol

|

KGX

|

|

ISIN

|

DE000KGX8881

|

|

WKN

|

KGX888

|

|

Bloomberg / Reuters

|

KGX GR / KGX.DE

|

|

Profit entitlement

|

From 1 January 2013

|

|

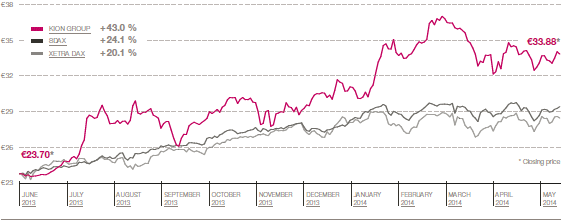

Closing price as at 31/03/2014

|

€34.03

|

|

Performance since beginning of 2014

|

10.8%

|

|

Market capitalisation as at 31/03/2014

|

€3,365.6 million

|

|

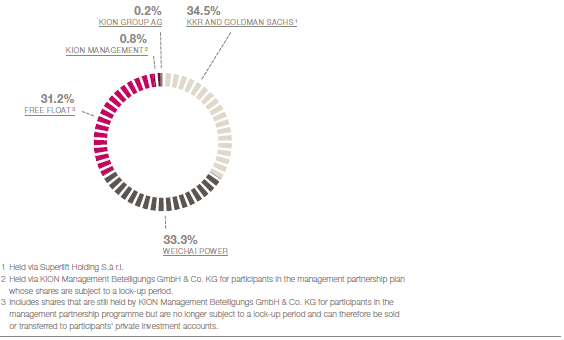

Free float

|

31.2%

|

|

Pro forma earnings per share based on 98.9 million no-par-value shares*

|

€0.28

|

|

Earnings per share*

|

€0.28

|