Segment overview

|

Segments 2012 | ||||||||||||

|

in € million |

Revenue |

Year- |

Adjusted |

Year- |

EBIT |

Year- |

Em- |

Year- | ||||

| ||||||||||||

|

|

|

|

|

|

|

|

|

| ||||

|

LMH |

3,132 |

9.8% |

330 |

18.3% |

523 |

>100% |

13,148 |

-4.6% | ||||

|

STILL |

1,677 |

0.6% |

123 |

22.4% |

98 |

>100% |

7,253 |

-0.5% | ||||

|

Financial Services |

509 |

6.2% |

1 |

-48.1% |

1 |

-48.1% |

112 |

16.7% | ||||

|

Other |

251 |

12.4% |

44 |

-34.6% |

-12 |

<-100% |

702 |

2.0% | ||||

|

Consolidation/ |

-842 |

0.0% |

-61 |

0.0% |

-61 |

0.0% |

- |

- | ||||

|

Total |

4,727 |

8.2% |

438 |

20.2% |

550 |

>100% |

21,215 |

-3.0% | ||||

Linde Material Handling (LMH) segment

The LMH segment encompasses the products and services of the Linde, Fenwick and Baoli brands.

Linde is a global premium brand and a technology leader. Its USP is its hydrostatic drive technology, which gives it a significant competitive edge worldwide and enables it to meet customer’s high standards of technology, efficiency, functionality and design. The product portfolio ranges from warehouse trucks to heavy trucks and container handlers and caters to all of the major application areas. Linde has been developing and manufacturing electric drive systems for decades and makes the resulting expertise available to external customers for use in a variety of applications.

In France, Linde products are sold under the Fenwick brand. The Baoli brand covers the lower price segment in China and other growth markets in Asia, eastern Europe, the Middle East and Africa as well as Central and South America.

LMH's strategic investment in Linde Hydraulics means it continues to hold a stake in one of the major producers of hydraulic components. An exclusive contract ensures the supply of these components over the long term, which provide the basis for the Linde trucks' precise lifting and handling capabilities as well as their low fuel consumption. LMH will continue to exploit the synergies between the technologies of the trucks and drive systems despite selling its majority stake in the hydraulics business.

In terms of unit sales of industrial trucks, Linde is the second largest brand worldwide and the market leader in Europe, while Fenwick occupies the number-one spot in France.

Around the globe, LMH can rely on a network of around 700 sales outlets (including Fenwick). Its sales are split roughly equally between its own sales companies and external dealers. Baoli has about 150 sales outlets.

STILL segment

The STILL and OM-STILL brands are grouped in the STILL segment. STILL is a global premium provider of trucks with diesel-electric drives. It focuses, above all, on the European and Latin American markets. In Brazil, STILL is ranked second in terms of product sales. OM-STILL is the market leader in Italy. By opening its own representative office in Singapore, an essential prerequisite to creating further growth in Southeast Asia has also been established.

The segment's portfolio consists of forklift trucks and warehouse trucks plus associated services. STILL is a market leader throughout Europe in electric forklift trucks and has also established innovative drive technologies on the market such as hybrid drive in particular. STILL has also positioned itself as a leading provider of intelligent intralogistics solutions. In this manner, STILL realizes the intelligent interplay of forklift trucks, warehousing technology and towing tractors, as well as process-oriented, value-added services concerning internal operations logistics processes, shelving systems and fleet management and services.

The STILL segment operates around 240 sales outlets in its markets, most of which it owns itself.

Financial Services (FS) segment

In view of the increased importance of financial services, KION laid the foundations for combining its activities in the FS segment in 2011 and completed the new segmentation in the year under review. Legally independent FS companies were set up in the main sales markets with a high volume of financing and leasing (France, Germany, Italy, Spain and the United Kingdom) so that financing and leasing business can be managed separately.

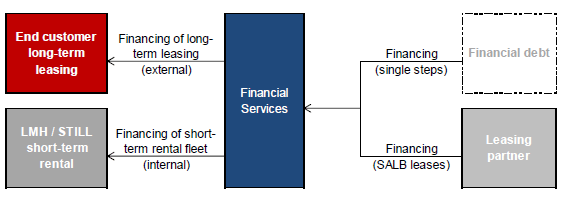

The purpose of the FS segment is to act as an internal funding partner for the LMH and STILL brand segments, providing finance solutions that promote sales. FS activities include the internal financing of the short-term rental fleet on the one hand, and the financing of long-term leasing business for KION Group customers on the other hand, as well as the accompanying risk management.

The key performance indicator for the FS segment is earnings before taxes (EBT).

When long-term leasing business is being conducted, FS itself acts as the contractual partner to customers and offers financing. Various financing models are available and give customers the greatest possible flexibility. In long-term business, FS is also responsible for risk management, which includes credit risk management as well as management of residual-value risk. Leases have an average term of four to five years.

In short-term leasing, FS is the internal financing partner of the brand segments: customers are offered rental trucks from a brand segment rental pool for short-term use. Financial performance largely depends on the rental fleet's capacity utilisation, which is controlled by the brand segments. Operational responsibility for the short-term rental business lies with the brand segments. FS acts as the contractual partner to the brand segments, providing the financing primarily in conjunction with external financial partners. The brand segments pay FS for its work in the form of an interest margin at a rate appropriate to the market.

FS works on refinancing with over 40 financing partners worldwide. Leasing is largely refinanced via sale and leaseback agreements, whilst the refinancing of single-step leases via financial liabilities still plays a subordinate role.

Business model of Financial Services

In addition to KION’s direct leasing to end clients via FS, lease financing is also procured through independent leasing providers. In such cases, the lessor is not KION, but rather an external leasing company.

Other segment

The Other segment primarily comprises KION GROUP GmbH with its holding activities, the KION Group's service companies, which provide cross-segment services. These include, in particular, IT services from KION Information Management Services GmbH and logistics services.

The subsidiaries of the Voltas MH brand company, which manufacture and sell counterbalance trucks and warehouse technology for the Indian market, also belong to this segment.