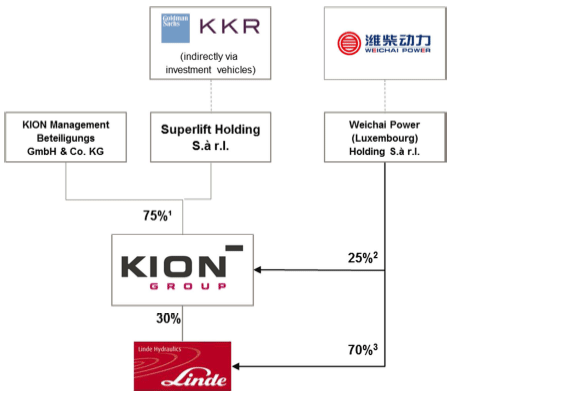

Shareholders

The consolidated financial statements cover the group of consolidated companies belonging to KION Holding 1 GmbH. As at the reporting date of 31 December 2012, KION Holding 1 GmbH indirectly held all shares in KION GROUP GmbH, which acts as the strategic management holding company and operational parent company of the KION Group (also referred to below as simply 'KION').

The number of shareholders increased in the year under review. In December 2012, the shareholders’ meeting of KION Holding 1 GmbH passed a resolution to increase the Company’s share capital. After the capital increase, Weichai Power Co., Ltd. (referred to below as 'Weichai Power') holds a 25 per cent share in KION Holding 1 GmbH through its subsidiary Weichai Power (Luxembourg) Holding S.à r.l. The contribution amount was paid by Weichai Power on 27 December 2012. The capital increase was entered in the commercial register in January 2013 (see ‘Events after the balance sheet date’). The remaining 75 per cent of the shares will be held on the one hand indirectly through investment vehicles and subsidiaries of former shareholders Goldman Sachs Capital Partners and KKR & Co. L.P., and on the other hand by an management participation company. The latter company manages about 5.7 per cent of the management holdings in KION Holding 1 GmbH.

Shareholders of the KION Group

1) Management participation of around 5.7 per cent included in 75 per cent share in KION Holding 1 GmbH

2) Weichai Power with further options to acquire additional shares

3) Under certain conditions Weichai Power’s share in Linde Hydraulics can be increased further.

The acquisition of shares by way of capital contributions made by Weichai Power further strengthened KION's capital structure. A detailed explanation can be found in the presentation of the financial position. Weichai Power has a call option vis-à-vis Superlift Holding S.à r.l. to acquire a further 3.3 per cent of the shares, which it can exercise before mid-2013 or, should KION be floated on the stock market in future, during the three months after flotation. Moreover, in the event of flotation on the stock market, Weichai Power can increase its equity investment (with full recognition of the resulting dilutive effects) to 33.3 per cent by means of a capital increase, if it previously held at least 28.3 per cent of the shares, or to 30.0 per cent, if it previously held less than 28.3 per cent of the shares.

The acquisition of shares is part of a long-term strategic partnership between the individual companies of KION and Weichai Power, at the core of which is close cooperation in the field of industrial trucks and hydraulic drive technology (further details can be found in the section Strategy of the KION Group). Under the agreement, Weichai Power also acquired a 70 per cent controlling interest in Linde Hydraulics GmbH & Co. KG (referred to below as 'Linde Hydraulics') with effect from 27 December 2012. The majority of the former hydraulics business of Linde Material Handling GmbH (referred to below as 'LMH GmbH') was transferred into this company. LMH GmbH continues to hold the remaining 30 per cent as a strategic investment. Weichai Power’s share in Linde Hydraulics can be increased further under certain conditions (see note 6).