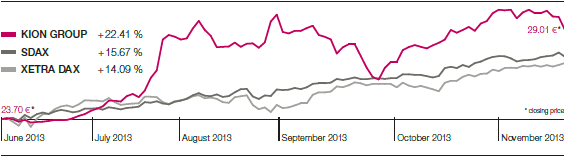

The shares of KION GROUP AG were listed in the Prime Standard section of the Frankfurt Stock Exchange for the first time on 28 June 2013. Following a periodic review of market indices on 23 September 2013, they were also included in the SDAX, the index of Deutsche Börse for those 50 public companies that rank below the MDAX in terms of market capitalisation and trading volume. This index reflects the performance of small-cap shares.

With a free-float market capitalisation of €544.1 million (as at 30 September 2013), the KION Group is among the ten largest stocks in the SDAX. In the third quarter, KION shares rose by 13.6 per cent and therefore outperformed the SDAX as a whole, which rose by 10.3 per cent. The share price was €27.10 at 30 September 2013, which was 12.0 per cent higher than its debut price on 28 June 2013.

|

Share data |

>>TABLE 01 | ||

| |||

|

|

| ||

|

Issuer |

KION GROUP AG | ||

|

Registered office |

Wiesbaden | ||

|

Commercial register no. |

HRB 27060 | ||

|

Share capital |

€ 98,900,000; divided into 98,900,000 no-par-value shares | ||

|

Share class |

No-par-value shares | ||

|

Stock exchange |

Frankfurt Stock Exchange | ||

|

Market segment |

Regulated market (Prime Standard) | ||

|

Index |

SDAX | ||

|

Stock exchange symbol |

KGX | ||

|

ISIN |

DE000KGX8881 | ||

|

WKN |

KGX888 | ||

|

Bloomberg |

KGX GR | ||

|

Reuters |

KGX.DE | ||

|

Profit entitlement |

From 1 January 2013 | ||

|

First day of trading |

28 June 2013 | ||

|

Opening price |

24.19 € | ||

|

Closing price as at 30/09/2013 |

27.10 € | ||

|

Change compared with opening price |

12.03 % | ||

|

Market capitalisation as at 30/09/2013 |

€ 2,680.2 million | ||

|

Pro forma earnings per share based on 98,9 million no-par-value shares* |

0.82 € | ||

|

Earnings per share* |

1.07 € | ||

KION shares have also performed well since the end of the reporting period, with the Xetra closing price reaching €29.01 on 7 November 2013, which was 20.9 per cent higher than the issue price.

|

Share performance |

>> GRAPHIC 01 |

Of the 2.6 million shares in the initial over-allotment option, 2.3 million were repurchased and returned to Superlift Holding S.à r.l., Luxembourg, within the 30-day stabilisation period. The over-allotment option was exercised for the remaining 0.3 million shares at the end of the stabilisation period and they therefore remained in the free float.

Following its successful IPO, the KION Group began preparations for an employee share programme to enable staff members, initially those in Germany, to benefit from the long-term success of the Company. From 28 August onwards, as authorised by the Shareholders’ Meeting on 13 June 2013, shares were repurchased via the stock exchange for this purpose. By 26 September 2013, a total of 200,000 shares had been repurchased, which represented around 0.2 per cent of the Company’s share capital. Many of the participants in the broadly subscribed KION management partnership programme (MPP), which was launched for senior managers when the KION Group was sold in 2006, are now free to sell the shares held on their behalf by KION Management Beteiligungs GmbH & Co. KG (MPP-KG) or to transfer them into their private investment accounts. As a result, these shares are now counted as part of the free float. Shares held by members of the KION Executive Board and members of the Management Boards of Linde Material Handling GmbH and STILL GmbH remain subject to a lock-up period of one year following the IPO.

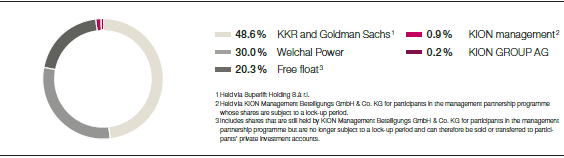

After completion of the share buyback program and including the shares still held by MPP-KG on behalf of KION executives that are not subject to lock-up restrictions, 20.3 per cent of KION shares are in free float.

|

Shareholder structure |

>> GRAPHIC 02 |

As a result of the IPO, there was a significant improvement in the KION Group’s credit profile, and consequently in its credit rating. In July 2013, Moody’s upgraded its corporate family rating by three notches, from B3 / positive to Ba3 / stable, while Standard & Poor’s also significantly improved its rating for the KION Group, from B / stable to BB– / positive.