KION shares

Share performance

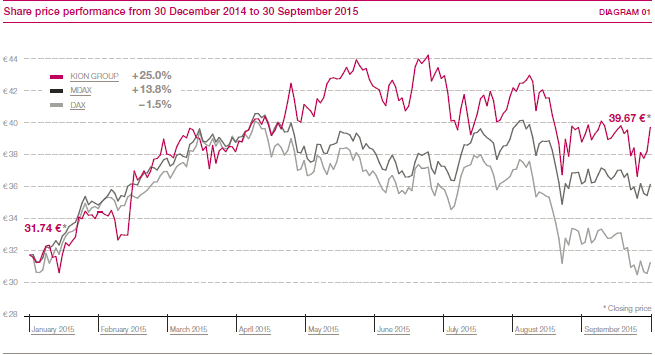

Equity markets worldwide experienced a sharp downturn in the third quarter. Turmoil on stock markets in Asia, uncertainty about future interest rates in the United States and, not least, the scandal at Volkswagen all contributed to huge falls in share prices. During the summer, KION shares ceded some of the price gains that they had made in the first half of the year, thereby reflecting the market trend. They closed at €39.67 on 30 September 2015. Nevertheless, this represented an increase of 25.0 per cent compared with the 2014 year-end closing price of €31.74. KION shares therefore performed better than the MDAX, which was up by just 13.8 per cent. They outperformed the DAX (down by 1.5 per cent) to an even greater extent. Having fallen to their low for the year so far of €30.64 on 14 January 2015, the shares reached their peak of €44.15 on 26 June 2015, thanks in part to their inclusion in the STOXX Europe 600 on 22 June 2015. As at 30 September 2015, market capitalisation stood at €3.9 billion, of which €2.4 billion was accounted for by shares in free float. > DIAGRAM 01

Shareholder structure

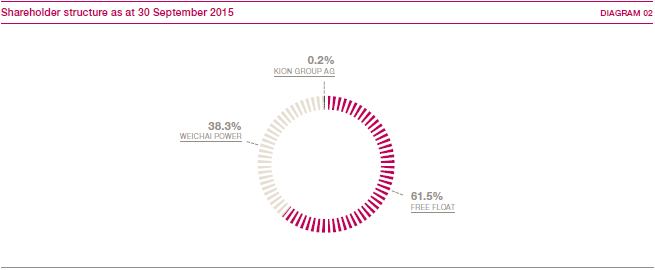

KION GROUP AG launched a share buy-back programme on 10 September 2015 to facilitate an employee equity programme. In the period up to 30 September 2015, 70,000 shares (roughly 0.07 per cent of the share capital) had been purchased. To do so, the KION Group used the authorisation granted at the Annual General Meeting on 13 June 2013.

Despite the acquisition of treasury shares, the proportion of shares held by KION GROUP AG remained unchanged at 0.2 per cent as at 30 September 2015. There were no other changes to the shareholder structure compared with the second quarter of 2015: Weichai Power Co. Ltd. continued to hold a stake of 38.3 per cent in KION as at 30 September 2015; the free float was 61.5 per cent. > DIAGRAM 02

Investor relations

The Executive Board and the KION Group’s investor relations team regularly gave presentations about the Group at investor conferences and roadshows and held face-to-face meetings with analysts and institutional investors.

Seventeen brokerage houses currently publish studies about KION shares. As at 30 September 2015, twelve analysts recommended KION shares as a buy and five rated them as neutral. The median target price specified for the shares was €46.00. > TABLE 01

|

Share data |

01 |

||

|

|||

|

Issuer |

KION GROUP AG |

||

|

Registered office |

Wiesbaden |

||

|

Share capital |

€98,900,000; divided into 98,900,000 no-par-value shares |

||

|

Share class |

No-par-value shares |

||

|

Stock exchange |

Frankfurt Stock Exchange |

||

|

Market segment |

Regulated market (Prime Standard) |

||

|

Index membership |

MDAX, STOXX Europe 600, MSCI Germany Small Cap |

||

|

Stock exchange symbol |

KGX |

||

|

ISIN |

DE000KGX8881 |

||

|

WKN |

KGX888 |

||

|

Bloomberg / Reuters |

KGX GR / KGX.DE |

||

|

Closing price as at 30/09/2015 |

€39.67 |

||

|

Performance since beginning of 2015 |

25.0% |

||

|

Market capitalisation as at 30/09/2015 |

€3,923.4 million |

||

|

Free float |

61.5% |

||

|

Earnings per share* |

€1.44 |

||

Corporate bond and credit rating

As before, the fixed-rate (6.75 per cent) tranche of the bond issued in February 2013, which has a volume of €450.0 million, is a key part of the Company’s funding structure. This bond is due to mature in 2020 and becomes redeemable in February 2016. Rating agency Standard & Poor’s rates the KION Group as BB+ with a stable outlook; the rating from Moody’s is Ba2 with a positive outlook.