KION shares

Price falls during the downturn

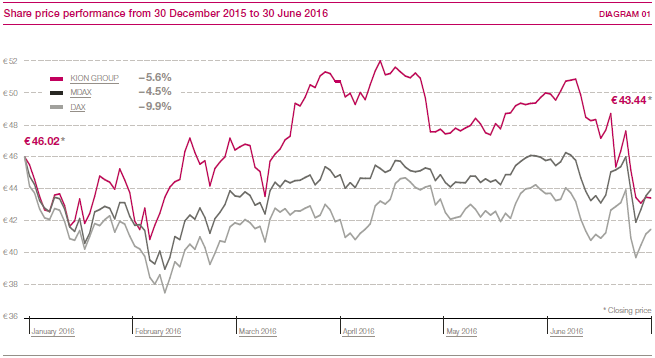

Following a good start to the second quarter, April saw the German stock market make up for most of the price falls of the first three months of the year. Amid a great deal of volatility, a downward trend then emerged, ending in plummeting share prices following the United Kingdom’s vote to leave the European Union. The DAX closed at 9,680 points on 30 June 2016, which was 9.9 per cent lower than at the end of 2015. The MDAX declined by 4.5 per cent over the six-month period.

KION shares initially defended their position above the €50 mark that they had reached in the first quarter and, on 14 April 2016, achieved their highest price of the year so far of €52.04. After the technical ex-dividend markdown in May, the shares passed the €50 mark again in June but then ceded all of the previous gains following the announcement of the Dematic acquisition and the downturn on the stock markets in the wake of the referendum in the UK. Falling by 5.6 per cent in the first half of 2016 to €43.44 (end of 2015: €46.02), KION shares outperformed the DAX, but not the MDAX. At the end of June, market capitalisation stood at €4.3 billion, of which €2.6 billion was attributable to shares in free float. > DIAGRAM 01