KION shares

Price falls during the downturn

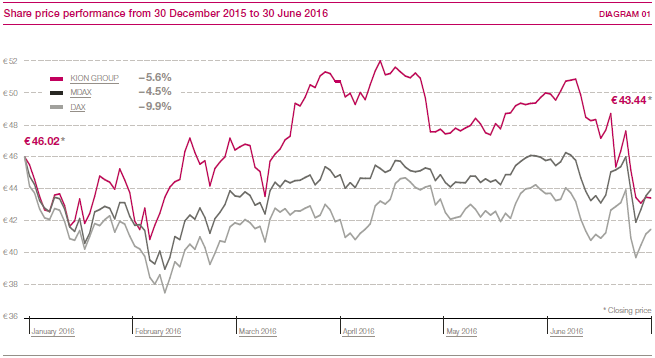

Following a good start to the second quarter, April saw the German stock market make up for most of the price falls of the first three months of the year. Amid a great deal of volatility, a downward trend then emerged, ending in plummeting share prices following the United Kingdom’s vote to leave the European Union. The DAX closed at 9,680 points on 30 June 2016, which was 9.9 per cent lower than at the end of 2015. The MDAX declined by 4.5 per cent over the six-month period.

KION shares initially defended their position above the €50 mark that they had reached in the first quarter and, on 14 April 2016, achieved their highest price of the year so far of €52.04. After the technical ex-dividend markdown in May, the shares passed the €50 mark again in June but then ceded all of the previous gains following the announcement of the Dematic acquisition and the downturn on the stock markets in the wake of the referendum in the UK. Falling by 5.6 per cent in the first half of 2016 to €43.44 (end of 2015: €46.02), KION shares outperformed the DAX, but not the MDAX. At the end of June, market capitalisation stood at €4.3 billion, of which €2.6 billion was attributable to shares in free float. > DIAGRAM 01

Annual General Meeting

The Annual General Meeting on 12 May 2016, at which 85.8 per cent of the share capital was represented, voted in favour of the Supervisory Board and Executive Board’s proposals by a large majority, including a dividend distribution of €0.77 per share. This represents an increase of 40.0 per cent on the previous year’s dividend and a rise in the dividend payout rate from 30.7 per cent to 35.0 per cent. The Annual General Meeting also renewed the authorisation to purchase treasury shares for five years. This will enable more shares to be repurchased, for example for the successful KION employee equity programme.

Stable shareholder structure

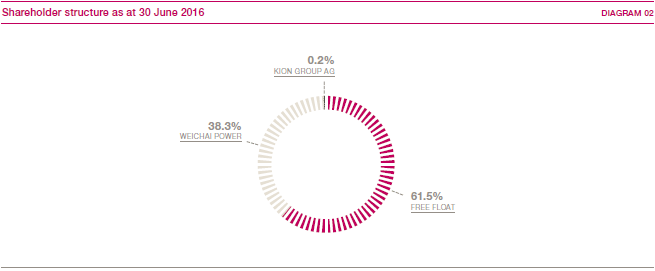

The shareholder structure remained stable in the reporting period. Holding a 38.3 per cent stake in the KION Group, Weichai Power Co. Ltd. continues to be the largest single shareholder. Weichai Power has undertaken not to acquire more than 49.9 per cent of KION shares before 28 June 2018 (so-called standstill agreement). KION GROUP AG continued to hold 0.2 per cent of the shares. The free float thus still accounted for 61.5 per cent. > DIAGRAM 02

Comprehensive coverage

Seventeen brokerage houses currently publish regular reports on the KION Group. As at 30 June 2016, nine analysts recommended KION shares as a buy and eight rated them as neutral. The median target price specified for the shares was €53.00 as at the reporting date. > TABLE 01

Share data |

01 |

||

|

|||

Issuer |

KION GROUP AG |

||

Registered office |

Wiesbaden |

||

Share capital |

€98,900,000; divided into 98,900,000 no-par-value shares |

||

Share class |

No-par-value shares |

||

Stock exchange |

Frankfurt Stock Exchange |

||

Market segment |

Regulated market (Prime Standard) |

||

Index membership |

MDAX, STOXX Europe 600, FTSE EuroMid, MSCI Germany Small Cap |

||

Stock exchange symbol |

KGX |

||

ISIN |

DE000KGX8881 |

||

WKN |

KGX888 |

||

Bloomberg / Reuters |

KGX:GR / KGX.DE |

||

Closing price as at 30/06/2016 |

€43.44 |

||

Performance since beginning of 2016 |

–5.62% |

||

Market capitalisation as at 30/06/2016 |

€4,295.7 million |

||

Free float |

61.5% |

||

Earnings per share* |

€0.97 |

||

Credit rating adjustments

Two rating agencies publish credit ratings on the KION Group. After the announcement of the Dematic acquisition in June, Standard & Poor’s rated the KION Group as BB+ with a negative outlook (previously: positive outlook). In June 2016, Moody’s adjusted its rating from Ba1 with a stable outlook to Ba1 with negative credit watch.