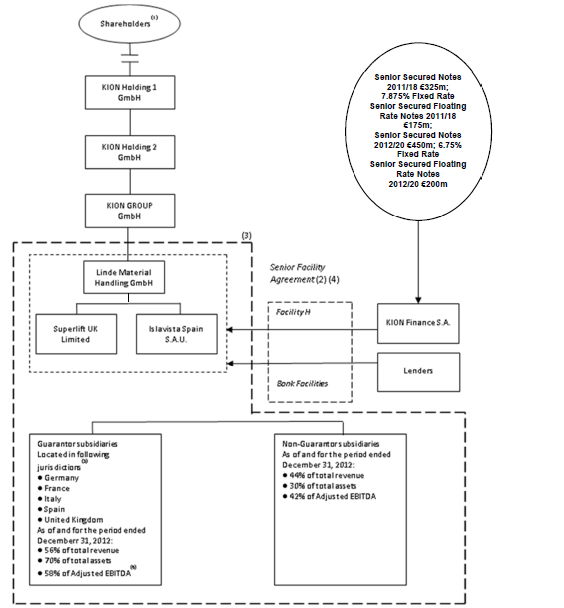

The following diagram summarizes certain aspects of our corporate structure.

(1) For information regarding our ultimate shareholders please see ‘‘— Our Shareholders’’ below.

(2) The Bank Facilities (including Facility H) under the Senior Facility Agreement rank equally in right of payment. On January 31, 2013, Superlift Funding, the sole lender of Term Loan Facility G, executed a deed poll pursuant to which it agreed that the Security Agent under the Senior Facilities Agreement may refrain from applying security enforcement proceeds in repayment of Facility G until such time as all other facilities have been repaid in full.

(3) These entities are all members of the KION Group. Total revenue, total assets and Adjusted EBITDA presented have been prepared on a consolidated basis. While the Issuer is consolidated with the KION Group for accounting purposes, it is not affiliated with us and does not belong to the KION Group.

(4) The other borrower under the Existing Bank Facilities is KION France Services S.A.S.

(5) In 2011, we incorporated financial services subsidiaries in each of Germany, France, Italy, Spain and the United Kingdom, which all are Guarantor subsidiaries, other than KION Financial Services Ltd.

(6) Adjusted EBITDA for Guarantor subsidiaries includes KION GROUP GmbH.

Our Shareholders

Our principal shareholders include Goldman Sachs Capital Partners, investment partnerships advised by Goldman, Sachs & Co. and certain of its affiliates, investment partnerships advised by KKR & Co. L.P. and certain of its affiliates and affiliates of Weichai Power Co. Ltd., a member of the Shandong Heavy Industry Group.

Since 1986, Goldman Sachs, through its Merchant Banking Division, has raised over US$82 billion of capital for corporate investments through 17 investment vehicles (including equity, mezzanine, senior secured loan and distressed funds) (together “GS Funds”). The GS Funds conduct privately negotiated investment activities globally.

Founded in 1976 and led by Henry Kravis and George Roberts, KKR is a leading global investment firm. With offices around the world, KKR manages assets through a variety of investment funds and accounts covering multiple asset classes. KKR seeks to create value by bringing operational expertise to its portfolio companies and through active oversight and monitoring of its investments. KKR complements its investment expertise and strengthens interactions with investors through its client relationships and capital markets platforms. KKR is publicly traded on the New York Stock Exchange (NYSE: KKR). For additional information, please visit KKR’s website at www.kkr.com.

Weichai Power is a leading automotive and equipment manufacturing group in China. It operates in three main business segments: power assembly (including engines, gear boxes and axles), commercial vehicles, and automobile electronics and parts, encompassing one of the most comprehensive product ranges in the industry. Weichai Power has the highest sales volume globally in high-speed heavy-duty engines and heavy-duty gearboxes. Its spark plug products enjoy the largest market share in China, and its heavy-duty axle products are considered a top brand in China. The company also ranks No. 4 in heavy duty trucks in China. The company was listed on the Hong Kong Stock Exchange in 2004 and on the Shenzhen Stock Exchange in 2007.

The state owned Shandong Heavy Industry Group is one of the most comprehensive leading industrial equipment manufacturers in China, with two complete industrial chains of the highest quality commercial vehicles and construction machinery. The Group has four listed subsidiaries, including Weichai Power, Weichai Heavy Machinery, Yaxing Motor Coach, and Shantui Construction Machinery, which is the largest bulldozer producer in the world.