Business model

In order to fully cater to the needs of its material handling customers worldwide, the KION Group’s business model covers every step of the value chain: product development, manufacturing, sales and logistics, spare parts business, truck rental and used trucks, system and software solutions, plus financial services that support the Group’s core industrial business. The KION Group operates a multi-brand strategy involving the three global brands Linde, STILL and Baoli plus the three regional brands Fenwick, OM STILL and Voltas MH.

The KION Group earns most of its consolidated revenue – 54.1 per cent in the year under review – from the sale of industrial trucks. The product portfolio includes counterbalance trucks powered by an internal combustion engine or electric drive, warehouse technology (ride-on and hand-operated industrial trucks) and towing vehicles for industrial applications. It covers all load capacities, from 1 tonne to 16 tonnes.

Worldwide research and development activities (R&D) enable the KION Group to consolidate and extend its technology leadership. The Company plays a pioneering role in hydrostatic and diesel-electric drive systems and in innovative energy-efficient and low-emission drive technologies. As at the end of 2014, the KION Group employed a total of 1,023 developers, of whom 282 worked in Asia. Total research and development spending amounted to €119.7 million in the year under review. This corresponded to 2.6 per cent of consolidated revenue, putting the KION Group above the industry average. The focus of the Group’s R&D activities is described in the ‘research and development’ section.

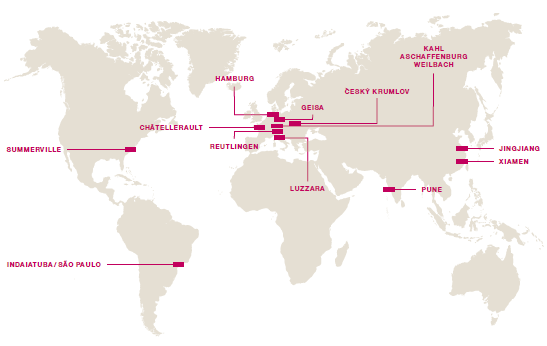

The KION Group operates a total of 14 production facilities for industrial trucks and components in eight countries. Another plant is currently being built in the Czech Republic, with production due to start there in 2016. Owing to the particular requirements of its business, the KION Group manufactures major components itself – notably lift masts, axles, counterweights and safety equipment – in order to ensure security of supply and the availability of spare parts for important components. Other components – such as hydraulic components, electronic components, rechargeable batteries, engine components and industrial tyres – are purchased through the KION Group’s global procurement organisation. > DIAGRAM 003

|

Production sites of the KION Group |

|

DIAGRAM 003 |

|

|

||

|

Linde Material Handling |

|

STILL |

|

Germany |

|

Germany |

|

Aschaffenburg: Counterbalance trucks with IC engine or electric drive, warehouse technology |

|

Hamburg: Counterbalance trucks with IC engine or electric drive, warehouse technology, components |

|

Weilbach: Component production |

|

Reutlingen: Very narrow aisle trucks |

|

Kahl: Spare parts warehouse, component production |

|

Geisa: Component production |

|

France |

|

Italy |

|

Châtellerault: Warehouse technology |

|

Luzzara: Warehouse technology |

|

Czech Republic |

|

Brazil |

|

Český Krumlov: Component production |

|

Indaiatuba / São Paulo: Counterbalance trucks with IC engine, warehouse technology |

|

United States |

|

|

|

Summerville: Counterbalance trucks with IC engine or electric drive, warehouse technology |

|

|

|

China |

|

|

|

Xiamen: Counterbalance trucks with IC engine or electric drive, heavy trucks, warehouse technology |

|

Other (KION India) |

|

|

India |

|

|

Jingjiang: Counterbalance trucks with IC engine or electric drive, warehouse technology |

|

Pune: Counterbalance trucks with IC engine or electric drive, warehouse technology |

The KION Group offers customers tailor-made solutions and only makes trucks specifically to order. More than a third of new trucks are fitted with technical components developed especially for a particular order. Advantages for customers in terms of total cost of ownership (TCO) underpin the Linde and STILL brands’ premium positioning. The trucks’ hallmarks are cost-efficiency, high productivity, comparatively low maintenance and high residual values.

The KION brand companies have an extensive sales and service network comprising around 1,300 outlets staffed by more than 13,000 service employees in over 100 countries. Approximately half of them are employed by the KION Group. In other cases, the Company relies on external dealers. The sales network in western Europe consists of exclusive dealers and Company-owned dealerships. In China, Linde has built up a broad network of more than 100 proprietary sales and service outlets. By contrast, distribution partners in Asia and South America usually offer more than one brand of truck.

The installed base, which comprised 1.2 million trucks worldwide at the end of 2014, is a source of spare parts, maintenance and repair business within the KION Group’s integrated business model.

The service business – spare parts, rental and used trucks, system and software solutions, and financial services – helps to smooth out fluctuations in consolidated revenue and reduces dependency on market cycles. In the reporting year, it contributed 45.9 per cent of consolidated revenue. This business also strengthens customer relationships, thereby helping to generate sales of new trucks.

Financial services support new truck business in many markets, forming another pillar of the service business within the integrated business model. Approximately 50 per cent of new truck business involves some form of financing via KION companies, external banks or dealers. Offering finance is therefore part of the truck sales process, and end customer finance is generally linked to a service contract throughout the term of the finance agreement. In the main sales markets with a high volume of financing and leasing, financial services are handled by legally independent financial services companies. These include long-term leasing to customers and internal financing of the brand companies’ short-term rental fleets.

There are also individual orders for repairs and maintenance work as well as for spare parts. In addition, the KION Group looks after entire customer fleets, using special fleet management software to monitor the trucks in the fleets.

The brand companies also have extensive used truck and rental truck businesses, allowing peaks in capacity requirements to be met and customers to be supported after their leases have expired. Once a lease has expired, the used truck is serviced at a reconditioning centre and can then be rented on a flexible, short-term basis, for example. The used and rental truck business is integrated into the LMH and STILL segments in terms of its operations, and its fleet of well in excess of 50,000 trucks is financed internally by Financial Services.