KION shares

Volatile stock market environment

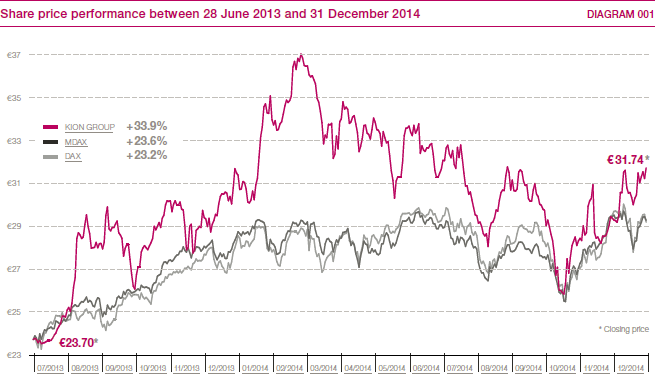

The global equity markets experienced severe volatility in 2014. Although investors were increasingly on the buy side because persistently low interest rates provided a strong incentive for investing in equities, sentiment was depressed, mainly by geopolitical tensions in the Middle East and Ukraine as well as fears of a renewed economic downturn in western Europe. As a result, there was a rapid series of sharp price fluctuations in both directions. Despite this high volatility, the DAX – which is regarded as the main barometer for prices in the German stock markets – closed at virtually the same level as at the end of 2013. Over the course of the year, the DAX had risen to 9,806 points, a gain of just 2.7 per cent, while the MDAX was up by 2.2 per cent.

Respectable performance by KION shares

The price of KION shares also ended 2014 virtually unchanged. They closed at €31.74 on 31 December 2014, which was 3.3 per cent higher than their 2013 year-end closing price of €30.73. The shares achieved their highest price of the year on 24 February when they reached €37.07. However, any gains were lost in the months that followed, in line with the performance of the market as a whole. The shares’ performance during the year was also influenced by three placements of blocks of shares by major shareholders KKR and Goldman Sachs (see next page). KION shares fell to their lowest price of the year, €25.83, on 15 October before recovering and catching up with the performance of the MDAX once more. > DIAGRAM 001

Inclusion in the MDAX

On 22 September 2014, KION GROUP AG was promoted from the SDAX to the MDAX, which comprises the 50 largest listed companies in Germany after those in the DAX, making KION shares even more attractive and visible to investors. > TABLE 001

|

Basic information on KION shares |

001 |

|

ISIN |

DE000KGX8881 |

|

WKN |

KGX888 |

|

Bloomberg |

KGX.GR |

|

Reuters |

KGX.DE |

|

Share type |

No-par-value shares |

|

Index |

MDAX |

At the end of the reporting year, the KION Group’s market capitalisation amounted to €3.1 billion, of which €1.5 billion was in free float. The average daily Xetra trading volume during the year was 106.3 thousand shares or €3.4 million. > TABLE 002

|

Share data |

002 |

||

|

|||

|

Closing price on 31/12/2013 |

€30.73 |

||

|

High for 2014 |

€37.07 |

||

|

Low for 2014 |

€25.83 |

||

|

Closing price on 31/12/2014 |

€31.74 |

||

|

Market capitalisation as at 31/12/2014 |

€3,138.6 million |

||

|

Performance in 2014 |

3.3% |

||

|

Average daily trading volume in 2014 (no. of shares) |

106.3 thousand |

||

|

Average daily trading volume in 2014 (€) |

€3.4 million |

||

|

Share capital |

€98,900,000 |

||

|

Number of shares as at 31/12/2014 |

98,900,000 |

||

|

Pro forma earnings per share for 2014 |

€1.79 |

||

|

Dividend per share for 2014* |

€0.55 |

||

|

Dividend payout rate* |

31% |

||

|

Total dividend payout* |

€54.3 million |

||

|

Equity ratio as at 31/12/2014 |

26.9% |

||

Sharp rise in free float

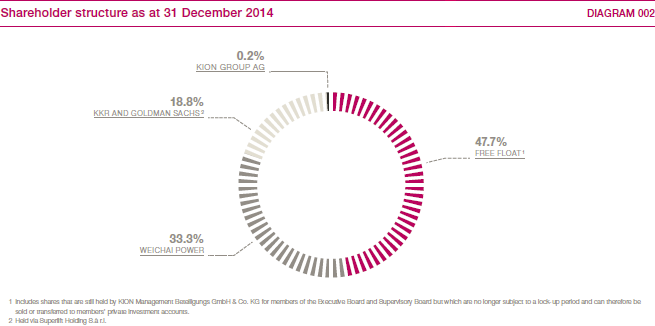

The shareholder structure changed significantly in the year under review, with a shift in favour of the free float. At the end of 2013, Weichai Power exercised its option to acquire shares from KKR and Goldman Sachs and thereby increase its stake from 30.0 per cent to 33.3 per cent. The transaction was completed on 15 January 2014. Weichai Power also undertook not to acquire more than 49.9 per cent of KION shares before 28 June 2018 (standstill agreement).

Meanwhile, KKR and Goldman Sachs carried out several placements that substantially reduced their stakes held indirectly via Superlift Holding. On 7 January, they sold a total of 10.7 million shares –10.8 per cent of KION shares – on the stock exchange, followed by the sale of around 7.5 million more shares –7.6 per cent of KION shares – on 10 June. KKR and Goldman Sachs disposed of a further block of 8.0 million shares –8.1 per cent of KION shares – on 10 November. As a result of these placements and the increase in Weichai’s stake, the proportion of shares held by KKR and Goldman Sachs indirectly via Superlift Holding at the end of 2014 stood at 18.8 per cent, compared with 48.6 per cent at the beginning of the year. Weichai Power is therefore the biggest single shareholder in KION GROUP AG.

Conversely, the free float increased from 20.3 per cent at the beginning of 2014 to a total of 47.7 per cent by the end of the year. Since October 2014, the shares in free float have also included those held by around 1,800 employees of the KION Group’s German companies who received blocks of shares at favourable terms under the KION Employee Equity Programme (KEEP) approved by the Executive Board. As a result of the programme, a total of 87.4 thousand shares – equivalent to 0.1 per cent of share capital – are now broadly distributed among the workforce. The KEEP programme is to be extended to other countries in 2015. In order to implement the KION Employee Equity Programme, KION GROUP AG made use in September of an authorisation granted by a resolution of the Extraordinary General Meeting on 13 June 2013 allowing treasury shares to be acquired for an employee share programme. A total of 251,000 shares have been repurchased since August 2013, 51,000 of them in September 2014. Of these treasury shares, 163,562 were left after the first stage of the KEEP programme – equivalent to 0.2 per cent of share capital – and they remain available for the employee share scheme.

On 28 June 2014, all participants in the KION management partnership plan (MPP) also became entitled to sell their shares or transfer them into their private investment accounts. The shares previously reported as being attributable to KION management are therefore now counted as part of the free float. > DIAGRAM 002

On 12 February 2015, KKR and Goldman Sachs placed a further 4.8 million shares (4.9 per cent of KION shares) in the market. As a result of this transaction, the free float increased again, from 47.7 per cent to 52.6 per cent. The proportion of shares held indirectly by KKR and Goldman Sachs via Superlift Holding therefore reduced from 18.8 per cent to 13.9 per cent.

Optimised funding structure, improved rating

On 15 April 2014, the KION Group redeemed two of its outstanding bond tranches before maturity in order to further optimise its corporate funding. The bonds had been issued prior to the IPO. The fixed-rate tranche of the corporate bond issued in 2011, which had a volume of €325.0 million, and the floating-rate tranche of the bond issued in 2013, which had a volume of €200.0 million, were repaid early in full. This was financed by drawdowns under the existing revolving credit facility and an increase of €198.0 million to the facility. By refinancing these bond tranches, the KION Group expects to save around €20 million in annual interest payments.

The fixed-rate (6.75 per cent) tranche of the bond issued in 2013, which has a volume of €450.0 million and a maturity date of 2020, remains in place.

On 7 April 2014, Moody’s raised the rating of the KION Group and the bonds from Ba3 to Ba2 with a stable outlook. Then, on 15 April 2014, S&P raised its rating for the KION Group from BB – with a positive outlook to BB, still with a positive outlook.

Overwhelming majority of financial analysts recommend KION shares

In 2014, the following six brokerage houses began to cover KION Group’s shares: HSBC, Baader Bank, MainFirst, Bankhaus Lampe, LBBW and NordLB. This brings the total number of brokerage houses that now regularly publish research on KION shares to 16. At the year end, twelve of the analysts recommended KION shares as a buy while four rated them as neutral. The median target price specified for the shares was €36.00.

Dividend of €0.55 per share planned

The Executive Board and Supervisory Board of KION GROUP AG will propose a dividend of €0.55 per share to the Annual General Meeting on 12 May 2015. This equates to a dividend payout rate of about 31 per cent of net income. Pro-forma earnings per share for 2014 came to €1.79.