KION shares

Share performance

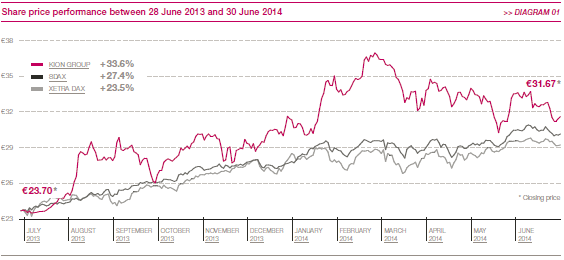

Against a backdrop of comparatively volatile trading, the price of KION shares fell by 6.9 per cent to €31.67 in the second quarter but was still 3.1 per cent higher than the 2013 year-end closing price of €30.73. The decrease in the share price was due, among other reasons, to a further placement in June and the technical ex-dividend markdown in May (see below). Although KION shares have not performed as well as the SDAX so far this year (up by 8.8 per cent), they have outperformed the MDAX (up by 1.5 per cent). The KION Group’s market capitalisation as at 30 June 2014 amounted to €3.1 billion (of which €1.2 billion was free float), the average daily Xetra trading volume from the start of the year was 89.2 thousand shares or €3.0 million.

At the end of the second quarter, the KION Group celebrated the first anniversary of its successful IPO with the share price climbing by 31.9 per cent overall compared with the issue price of €24.00 on 26 June 2013. >> DIAGRAM 01

Shareholder structure

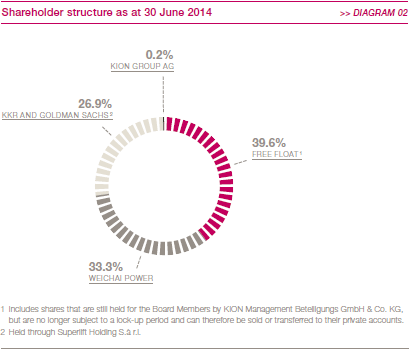

There were further changes to the shareholder structure in the second quarter of 2014. The free float increased by 7.6 per cent following the placement of around 7.5 million shares attributable to Goldman Sachs on 10 June 2014 at a price of €32.70. As was the case with the previous placement in January, this transaction closed within a few hours and was significantly oversubscribed. The proportion of shares held by KKR and Goldman Sachs via Superlift Holding now stands at 26.9 per cent. Superlift Holding is again subject to a lock-up period until 10 September 2014. Furthermore, all participants in the KION management partnership plan (MPP) are now free to sell their shares or transfer them into their private investment accounts. The shares previously reported as being attributable to KION management are therefore now counted as part of the free float, which has risen from 31.2 per cent as at 2 May 2014 (cut-off date for the last quarterly report) to a total of 39.6 per cent. With its stake unchanged at 33.3 per cent, Weichai Power is now the biggest single shareholder of KION GROUP AG. There is a mutual right of first offer between Weichai Power on the one hand and KKR and Goldman Sachs on the other with respect to their shareholdings. Weichai Power has also undertaken not to acquire more than 49.9 per cent of the KION Group’s shares between now and 28 June 2018 (as part of a standstill agreement). >> DIAGRAM 02

Dividend and 2014 Annual General Meeting

At the Annual General Meeting of KION GROUP AG on 19 May 2014, with 90.21 per cent of the voting share capital in attendance, all resolutions proposed by the Company’s management were accepted by a large majority. This included a resolution on distributing a dividend of €0.35 per share. The total dividend payout of €34.5 million represented a dividend payout ratio of 25 per cent of net income. Other agenda items related to the approval of the Executive Board remuneration system and the creation of authorised and conditional capital – equating in total to 10 per cent of the existing share capital – with the option of excluding pre-emptive rights.

Investor relations

The main area of investor relations work in the second quarter was the Annual General Meeting, which was attended by some 150 shareholders. The speeches of the Chief Executive Officer and the chairman of the Supervisory Board were broadcast live at kiongroup.com/agm. A webcast of the Chief Executive Officer’s speech is available permanently on the Company’s website.

In addition, the Executive Board and the KION Group’s investor relations team talked directly to institutional investors and analysts on many occasions. These included the dbAccess Pan European Small and Mid Cap Conference in April, the dbAccess German, Swiss and Austrian Conference in June and the JP Morgan European Capital Goods Conference, also in June. The Executive Board reported on the quarterly results during an update call. Several roadshows and a number of one-on-one meetings also took place. The transcripts from the quarterly update calls along with presentations can be found on the Investor Relations section of our website under Events & Presentations.

During the second quarter, two more investment banks initiated research coverage on the KION Group’s shares. HSBC recommends the KION Group with a rating of ‘overweight’, while Baader Bank’s initial rating was ‘buy’. Twelve brokerage houses now publish regular studies about KION shares. As at 31 July, 8 analysts recommended KION shares as a buy and 4 rated them as neutral. The median target price specified for the shares was €36.55 in July. >> TABLE 01

|

Share data |

>>TABLE 01 |

||

|

|||

|

|

|

||

|

Issuer |

KION GROUP AG |

||

|

Registered office |

Wiesbaden |

||

|

Share capital |

€ 98,900,000; divided into 98,900,000 no-par-value shares |

||

|

Share class |

No-par-value shares |

||

|

Stock exchange |

Frankfurt Stock Exchange |

||

|

Market segment |

Regulated market (Prime Standard) |

||

|

Index |

SDAX, MSCI Small Cap Germany |

||

|

Stock exchange symbol |

KGX |

||

|

ISIN |

DE000KGX8881 |

||

|

WKN |

KGX888 |

||

|

Bloomberg / Reuters |

KGX GR / KGX.DE |

||

|

Closing price as at 30/06/2014 |

€31.67 |

||

|

Performance since beginning of 2014 |

3.1% |

||

|

Market capitalisation as at 30/06/2014 |

€3,132.2 million |

||

|

Free float |

39.6% |

||

|

Earnings per share* |

€0.60 |

||

Corporate bond and credit rating

On 15 April 2014, the KION Group redeemed two of its outstanding bond tranches early in order to further optimize its post-IPO corporate funding. The fixed-rate tranche of the corporate bond issued in 2011 with an amount of €325.0 million and the floating-rate tranche of the bond issued in 2013 with an amount of €200.0 million, were repaid early in full. These repayments were financed by drawdowns from the existing revolving credit facility and an extension to the loan facility of €198.0 million. The KION Group expects the refinancing of the bonds, which were issued before the IPO, to result in a saving of approximately €20 million per year in interest payments, the full effect of which will not come through until 2015 onwards owing to non-recurring financial expenses of €23.2 million incurred in the second quarter in connection with the early repayment. The fixed-rate (6.75 per cent) tranche of the bond issued in 2013, which has a volume of €450.0 million and a maturity date of 2020, remains in place. Between 7 and 14 July 2014, the KION Group asked the holders of this bond to approve an amendment of the bond contract. As at 14 July 2014, 82.61 per cent of the holders – more than the required majority of 50 per cent – had given their consent.

On 7 April 2014, Moody’s raised the rating of the KION Group and the bonds from Ba3 to Ba2 with a stable outlook. Then, on 15 April 2014, S&P raised its rating for the KION Group from BB– with a positive outlook to BB, still with a positive outlook.