KION shares

Moderate increase in equity markets

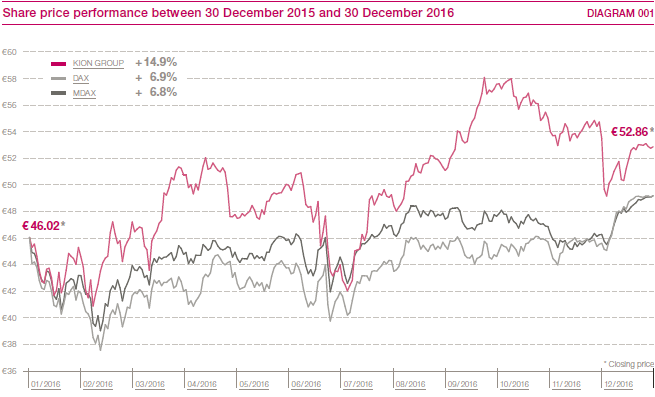

The European stock markets only showed a moderate increase over the course of 2016. Although prices fell sharply at the start of the year on the back of weaker growth in China, geopolitical tensions, the collapse of the oil price and other factors, they then began rising again as the interest rate environment remained favourable to equities. The surprising vote for Brexit in the middle of the year created some turmoil, but only for a short time, and the second half of 2016 was characterised by minimal fluctuation within a narrow range. Moreover, the outcome of the US presidential election and Italy’s referendum did not trigger any significant price reactions. The moderate upward trend observed at the end of 2016 was primarily supported by good economic data, a strongly rebounding oil price and positive leading indicators. The DAX closed the year at 11,481 points, an increase of 6.9 per cent. The MDAX rose by 6.8 per cent to reach 22,189 points.

Gain for the KION share price

KION shares outperformed the benchmark indices in 2016. They closed at €52.86 on 30 December 2016, which was 14.9 per cent higher than their 2015 year-end closing price of €46.02. The share price largely followed the market trend in the first half of the year, registering its low for the year of €40.84 on 8 February 2016. At the end of June, KION shares were also affected by the downward movement seen after the surprising outcome of the referendum in the UK in favor of leaving the European Union. From July, however, KION shares were able to increasingly buck the market trend thanks to a strong business performance and the positive perception of the Dematic acquisition. The successful capital increase on 18 July 2016 was also accompanied by rising prices. KION shares achieved their highest price of the year on 22 September 2016 when they reached €58.09. After falling in the fourth quarter, the price at the end of the year was €52.86. > DIAGRAM 001

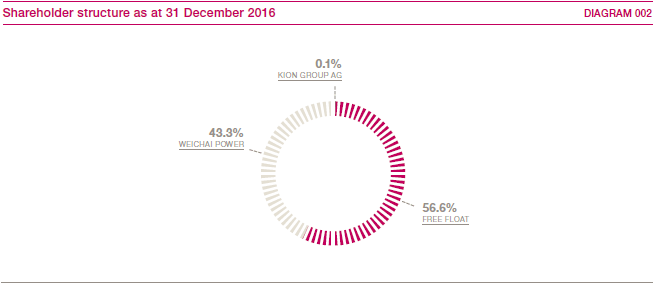

KION GROUP AG’s market capitalisation was €5.8 billion as at 30 December 2016. Of this total, 56.6 per cent or €3.3 billion was in free float. The average daily Xetra trading volume in 2016 was 230 thousand shares or €11.4 million, up considerably on the prior year. > TABLE 001

Basic information on KION shares |

001 |

ISIN |

DE000KGX8881 |

WKN |

KGX888 |

Bloomberg |

KGX:GR |

Reuters |

KGX.DE |

Share type |

No-par-value shares |

Index |

MDAX, STOXX Europe 600, MSCI Germany Small Cap, FTSE EuroMid |

Acquisition-related capital increase and employee equity programme

On 18 July 2016, KION GROUP AG placed 9,890,000 new shares at a price of €46.44 each in order to partly finance the acquisition of Dematic. The authorised capital was used in full for this purpose and the Company’s share capital was increased by 10 per cent against cash contributions; shareholders’ pre-emption rights were excluded. The anchor shareholder Weichai Power acquired 5,934,000, or 60 per cent, of the new shares, increasing its stake in the Company to around 40.2 per cent at that time. The remaining shares were placed with institutional investors in an accelerated bookbuilding process. The gross proceeds from the capital increase amounted to approximately €459.3 million.

On 12 December 2016, Weichai Power acquired further KION shares, taking its stake in KION GROUP AG to the current level of 43.3 per cent. Weichai Power has undertaken not to acquire more than 49.9 per cent of KION shares before 28 June 2018 (as part of a standstill agreement).

Between 12 and 27 September 2016, KION GROUP AG repurchased a total of 50,000 shares (around 0.05 per cent of the share capital) for use in the KION Employee Equity Programme (KEEP).

The proportion of shares held by the KION Group changed only slightly as a result of KEEP and stood at 0.1 per cent as at 31 December 2016. The free float accounted for 56.6 per cent at the end of the year. > DIAGRAM 002

KION shares predominantly recommended as a buy

As at 31 December 2016, nineteen brokerage houses published regular reports on the KION Group. Thirteen analysts recommended KION shares as a buy, five rated them as neutral and one analyst recommended selling them. The median target price specified for the shares was €61.00.

Dividend of €0.80 per share planned

The Executive Board and Supervisory Board of KION GROUP AG will propose a dividend of €0.80 per share to the Annual General Meeting on 11 May 2017. With earnings per share for 2016 of €2.38, this equates to a dividend payout rate of around 35 per cent of net income. > TABLE 002

Share data |

002 |

||

|

|||

Closing price at the end of 2015 |

€46.02 |

||

High for 2016 |

€58.09 |

||

Low for 2016 |

€40.84 |

||

Closing price at the end of 2016 |

€52.86 |

||

Market capitalisation at the end of 2016 |

€5,750.6 million |

||

Performance in 2016 |

14.9% |

||

Average daily trading volume in 2016 (no. of shares) |

230.1 thousand |

||

Average daily trading volume in 2016 (€) |

€11.4 million |

||

Share capital |

€108,790,000 |

||

Number of shares |

108,790,000 |

||

Earnings per share for 2016 |

€2.38 |

||

Dividend per share for 2016* |

€0.80 |

||

Dividend payout rate* |

35% |

||

Total dividend payout* |

€86.9 million |

||

Equity ratio as at 31/12/2016 |

22.3% |

||

Financing and credit ratings

In February 2016, the KION Group successfully replaced the financing dating back to the time before the IPO, updating its financing structure with much better terms. The current senior facilities agreement comprises a revolving credit facility of €1,150.0 million (maturing in February 2022) and a fixed-term tranche of €350.0 million (maturing in February 2019). An agreement was reached for a firmly committed bridge loan of originally €3.0 billion as financing for the acquisition of Dematic. The financing volume was reduced by the amount of the proceeds from the issue of shares and now stands at just over €2.5 billion. To refinance part of the bridge loan, the KION Group issued promissory notes (Schuldscheindarlehen) in February 2017 amounting to €958.0 million with fixed or floating coupons. The promissory notes mature in May 2022, April 2024 or April 2027. Three rating agencies publish credit ratings for the KION Group. On 4 January 2017, Fitch Ratings awarded the KION Group a long-term issuer rating of BBB- with a stable outlook. This is the first time that the KION Group has received an investment-grade rating. The credit rating awarded to KION by rating agency Standard & Poor’s has been BB+ with a negative outlook since June 2016. In November, Moody’s lowered the outlook from stable to negative with a credit rating of Ba1.