KION shares

Volatile stock market conditions for shares in the first half of 2018

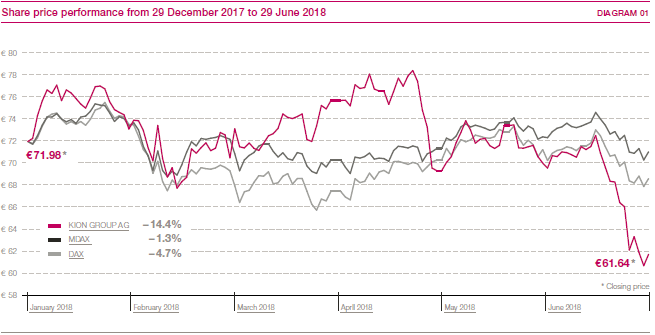

Germany’s stock markets experienced substantial volatility in the first six months of the year. The DAX barely moved in the second quarter, so it was unable to recoup the losses of the first months. It closed at 12,306 points at the end of the reporting period, which was 4.7 per cent lower than at the end of 2017. The MDAX declined by 1.3 per cent. KION shares initially rose sharply to reach a high of €78.48 on 23 April 2018, before losing ground due to the volatile conditions and closing at €61.64 on 29 June 2018 – a loss of 14.4 per cent. At the end of June, market capitalisation stood at €7.3 billion, of which €4.1 billion was attributable to shares in free float. > DIAGRAM 01

Significant dividend increase

The Annual General Meeting on 9 May 2018, at which around 80 per cent of the share capital was represented, approved the Supervisory Board and Executive Board’s proposals with a large majority. This included a 23.8 per cent increase in the dividend to €0.99 per share (2017: €0.80 per share). The total dividend payout was therefore up by more than a third at €116.8 million (2017: €86.9 million). This equates to around 35 per cent of the net income for 2017 adjusted for the non-cash revaluation of deferred tax liabilities (net) in connection with the corporate income tax rate reduction approved in the US.

Stable shareholder structure

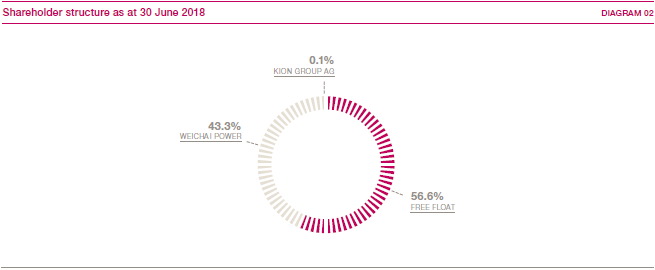

The shareholder structure as at 30 June remained stable compared with the end of 2017. Weichai Power Co. Ltd. was still the largest single shareholder with an unchanged stake of 43.3 per cent, while KION GROUP AG continued to hold 0.1 per cent and 56.6 per cent of shares remained in free float. > DIAGRAM 02

On 3 July 2018, Weichai Power Co. Ltd. increased its stake in the KION Group from 43.3 per cent to 45.0 per cent. As 0.1 per cent of shares continue to be held by KION GROUP AG, a total of 54.9 per cent are now in free float.

Comprehensive coverage

Twenty brokerage houses currently publish regular reports on the KION Group. As at 30 June 2018, eleven analysts recommended KION shares as a buy and nine rated them as neutral. At mid-year the median target price specified by the equity analysts was €80.00. > TABLE 01

Share data |

01 |

||

|

|||

Issuer |

KION GROUP AG |

||

Registered office |

Frankfurt am Main |

||

Share capital |

€118,090,000; divided into 118,090,000 no-par-value shares |

||

Share class |

No-par-value shares |

||

Stock exchange |

Frankfurt Stock Exchange |

||

Market segment |

Regulated market (Prime Standard) |

||

Index membership |

MDAX, STOXX Europe 600, FTSE EuroMid, MSCI World, MSCI Germany Small Cap |

||

Stock exchange symbol |

KGX |

||

ISIN |

DE000KGX8881 |

||

WKN |

KGX888 |

||

Bloomberg / Reuters |

KGX:GR / KGX.DE |

||

Closing price as at 30/06/2018 |

€61.64 |

||

Performance since beginning of 2018 |

–14.4% |

||

Market capitalisation as at 30/06/2018 |

€7,279.1 million |

||

Free float |

56.6% |

||

Earnings per share* |

€1.26 |

||

Credit rating remains good

The KION Group continues to have an investment-grade credit rating. Since January 2017, the Group’s long-term issuer rating from Fitch Ratings has been BBB– with a stable outlook, while Standard & Poor’s has classified the KION Group as BB+ with a positive outlook since September 2017.