KION shares

Strong recovery in the first half of 2019

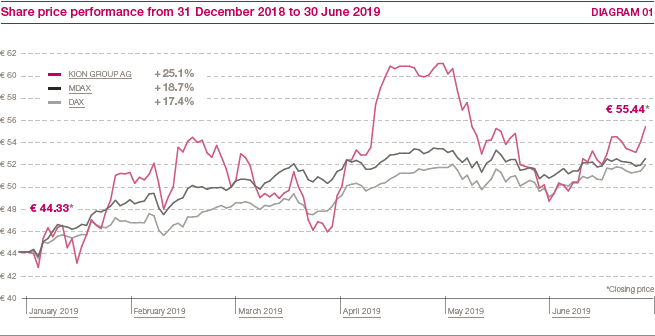

In the first half of 2019, the German equity markets recouped a large part of the losses that they had suffered in 2018. The DAX index settled back above the 12,000-point mark in the second quarter and ended the midpoint of the year at 12,399 points, which was 17.4 per cent higher than at the close of 2018. The MDAX added 18.7 per cent over the same period. KION shares also rose after experiencing falls in 2018 and outperformed their benchmark index, the MDAX, with a gain of 25.1 per cent to close the period at €55.44. On 30 April, they reached a high for the year to date of €61.04. The closing price as at 30 June 2019 equates to market capitalisation of €6.5 billion, of which €3.6 billion is attributable to shares in free float. > DIAGRAM 01

Shareholders agree record dividend

The Annual General Meeting on 9 May 2019, at which 87.4 per cent of the voting share capital was represented, adopted the resolution on the appropriation of profit for 2018 with a large majority. The proposed payment of €1.20 per dividend-bearing share was 21.2 per cent higher than in the prior year. The total dividend payout thus increased from approximately €116.8 million in 2018 to €141.5 million. With earnings per share for 2018 of €3.39, this equates to a dividend payout rate of around 35 per cent.

Stable shareholder structure

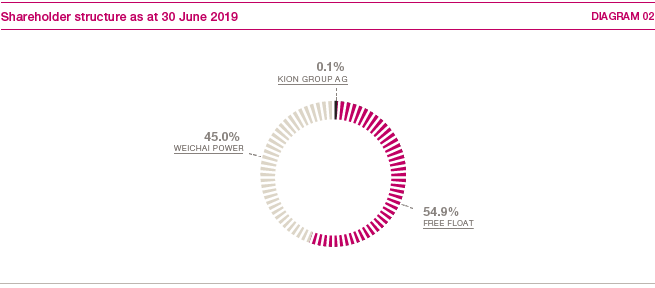

The shareholder structure remained unchanged in the reporting period. Weichai Power Co., Ltd. has retained its 45.0 per cent stake and thus remains the largest single shareholder, while KION GROUP AG continues to hold 0.1 per cent of the shares. The free float as at 30 June 2019 thus stayed at 54.9 per cent. > DIAGRAM 02

Comprehensive coverage

22 brokerage houses currently publish regular reports on the KION Group. As at 30 June 2019, twelve analysts recommended KION shares as a buy, seven rated them as neutral and three recommended selling them. The median target price specified by the share analysts was €63.50 at the end of the reporting period.

Share data

|

Share data |

01 |

||

|

|||

|

Issuer |

KION GROUP AG |

||

|

Registered office |

Frankfurt am Main |

||

|

Share capital |

€118,090,000; divided into 118,090,000 no-par-value shares |

||

|

Share class |

No-par-value shares |

||

|

Stock exchange |

Frankfurt Stock Exchange |

||

|

Market segment |

Regulated market (Prime Standard) |

||

|

Index membership |

MDAX, STOXX Europe 600, FTSE EuroMid, MSCI World, MSCI Germany Small Cap |

||

|

Stock exchange symbol |

KGX |

||

|

ISIN |

DE000KGX8881 |

||

|

WKN |

KGX888 |

||

|

Bloomberg / Reuters |

KGX:GR / KGX.DE |

||

|

Closing price as at 30/06/2019 |

€55.44 |

||

|

Performance since beginning of 2019 |

+25.1% |

||

|

Market capitalisation as at 30/06/2019 |

€6,546.9 million |

||

|

Free float |

54.9% |

||

|

Basic earnings per share* |

€1.87 |

||

Stable credit rating

The KION Group continues to have an investment-grade credit rating. Since January 2017, the Group’s long-term issuer rating from Fitch Ratings has been BBB– with a stable outlook, while Standard & Poor’s has classified the KION Group as BB+ with a positive outlook since September 2017.