KION shares

Inclusion in the MDAX

KION GROUP AG was included in Deutsche Börse’s MDAX on 22 September. Before that, the shares had been part of the SDAX for about a year. This promotion to the mid-cap segment, comprising the 50 largest listed companies in Germany after those in the DAX, will make KION shares even more attractive and visible to investors.

Share performance

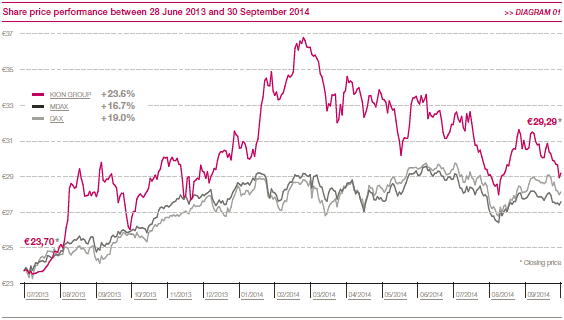

Amid volatile conditions on the stock market, which has been on a downward trend recently, the price of KION shares fell by 7.5 per cent to €29.29 in the third quarter and was 4.7 per cent below the 2013 year-end closing price of €30.73. The shares’ performance was therefore slightly behind that of the MDAX as a whole, which declined by 3.5 per cent over the nine-month period. As at 30 September 2014, the KION Group’s market capitalisation amounted to €2.9 billion (of which €1.1 billion was in free float). The average daily Xetra trading volume from the start of the year was 84.6 thousand shares or €2.7 million. >> Diagram 01

Shareholder structure

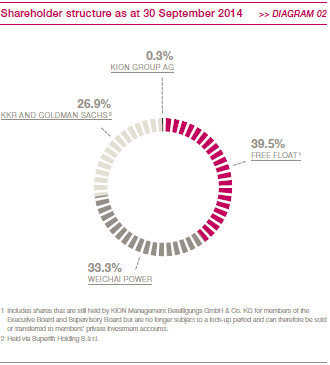

There was a minor change to the shareholder structure as a result of share buybacks, with KION GROUP AG repurchasing 51,000 shares between 10 September and 30 September 2014. As at 30 September, the Company therefore held a total of 251,000 no-par-value shares in treasury, corresponding to 0.25 per cent of the share capital. Authorisation to acquire treasury shares for an employee share programme had been granted by means of a resolution of the Extraordinary General Meeting on 13 June 2013 before the IPO. At the start of October, the Executive Board of KION GROUP AG decided to implement such an employee share programme. All employees eligible to take part were able to acquire KION shares during an offer period in October. The free float edged down to 39.5 per cent, compared with 39.6 per cent at 30 June.

With its stake unchanged at 33.3 per cent, Weichai Power remains the biggest single shareholder of KION GROUP AG. There is a mutual right of first offer between Weichai Power on the one hand and KKR and Goldman Sachs on the other with respect to their shareholdings. Weichai Power has also undertaken not to acquire more than 49.9 per cent of the KION Group’s shares between now and 28 June 2018 (as part of a standstill agreement). The proportion of shares held by KKR and Goldman Sachs via Superlift Holding stands at 26.9 per cent. >> Diagram 02

Investor relations

The Executive Board and the KION Group’s investor relations team talked directly to institutional investors and analysts on many occasions in the third quarter. In September, for example, the KION Group participated in several conferences and roadshows and held numerous one-on-one meetings.

The Executive Board reported on the quarterly results during an update call. The transcripts from the quarterly update calls along with presentations are available on our website under Investor Relations / Presentations.

During the third quarter, two more brokerage houses began covering the KION Group’s shares. Mainfirst recommended the KION Group with a rating of ‘outperform’, while Bankhaus Lampe’s initial rating was ‘buy’. A total of 14 brokerage houses now regularly publish research on KION shares. As at 30 September, ten analysts recommended KION shares as a buy and four rated them as neutral. The median target price specified for the shares was €37.00. >> Table 01

|

Share data |

>>TABLE 01 |

||

|

|||

|

|

|

||

|

Issuer |

KION GROUP AG |

||

|

Registered office |

Wiesbaden |

||

|

Share capital |

€98,900,000; divided into 98,900,000 no-par-value shares |

||

|

Share class |

No-par-value shares |

||

|

Stock exchange |

Frankfurt Stock Exchange |

||

|

Market segment |

Regulated market (Prime Standard) |

||

|

Index |

MDAX |

||

|

Stock exchange symbol |

KGX |

||

|

ISIN |

DE000KGX8881 |

||

|

WKN |

KGX888 |

||

|

Bloomberg / Reuters |

KGX GR / KGX.DE |

||

|

Closing price as at 30/09/2014 |

€29.29 |

||

|

Performance since beginning of 2014 |

–4.7% |

||

|

Market capitalisation as at 30/09/2014 |

€2,896.8 million |

||

|

Free float |

39.5% |

||

|

Earnings per share* |

€1.19 |

||

Corporate bond and credit rating

The KION Group has issued a 6.75 per cent fixed-rate corporate bond with a volume of €450.0 million through its subsidiary KION Finance S.A. Placed in 2013, the bond is due to mature in 2020.

The KION Group has been given credit ratings by Standard & Poor’s (Ba2 with a stable outlook) and Moody’s (BB with a positive outlook).