KION shares

Highly volatile stock market environment

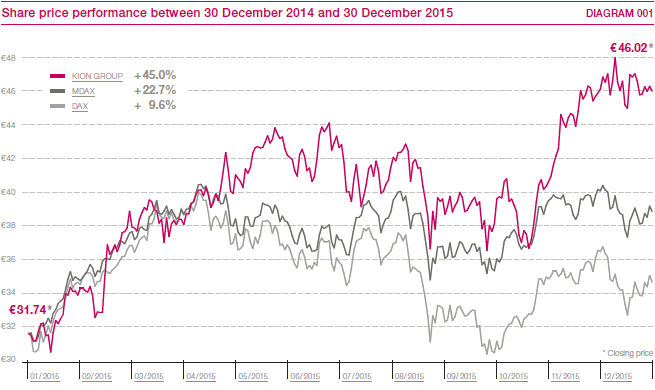

The world’s stock markets were very nervous in 2015 and were characterised by strong volatility. Equities were a popular asset class as market interest rates remained very low, and this led to share price rises, especially in the first half of the year. However, the pricing level reached made the markets highly susceptible to external shocks. Slower growth in Asia and Latin America, turbulent capital markets in China, uncertainty about future monetary policy in the United States, geopolitical tension and, not least, the Volkswagen scandal resulted in a sharp price correction in the third quarter. The DAX, Germany’s main index, ceded virtually all of the gains that it had made in the first six months. In the fourth quarter, however, most indices rose considerably on the back of persistently good growth figures from industrialised nations. The DAX closed the year at 10,743 points, representing an increase of 9.6 per cent. The MDAX climbed by an even more impressive 22.7 per cent to reach 20,775 points, thereby significantly outperforming the blue-chip index.

Strong growth for KION shares

KION shares finished 2015 considerably higher than where they had begun. They closed at €46.02 on 30 December 2015, which was 45.0 per cent higher than their 2014 year-end closing price of €31.74. Having reached the lowest price of the year of €30.64 on 14 January, the share price moved steadily upward in the first half of the year. Reflecting the trend in the market, the shares fell in the third quarter before beginning a steep uptrend in November to reach their highest price of the year of €48.00 on 7 December. Among the positive influencing factors were the inclusion in the STOXX Europe 600 and the release of good growth figures and strong results. Looking at the year as a whole, the KION Group comfortably outperformed both the MDAX and the DAX. > DIAGRAM 001

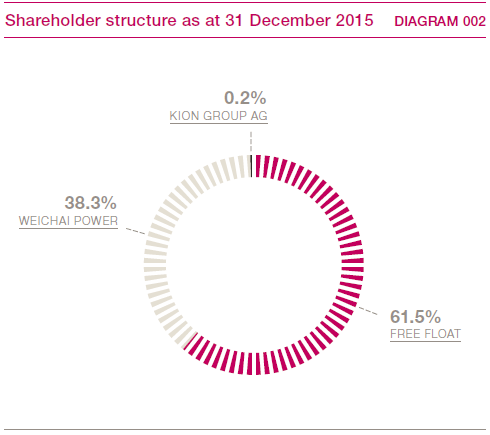

The KION Group’s market capitalisation was €4.6 billion at the end of the reporting year. Of this total, 61.5 per cent or €2.8 billion was in free float. The average daily Xetra trading volume in 2015 was 206 thousand shares or €8.3 million, up considerably on the prior year. This can be attributed to KION GROUP AG’s inclusion in the MDAX from September 2014 and the further increase in the free float. > TABLE 001

|

Basic information on KION shares |

001 |

|

ISIN |

DE000KGX8881 |

|

WKN |

KGX888 |

|

Bloomberg |

KGX:GR |

|

Reuters |

KGX.DE |

|

Share type |

No-par-value shares |

|

Index |

MDAX, STOXX Europe 600, MSCI Germany Small Cap |

Further rise in free float and share repurchases

Superlift Holding S.à r.l. (Superlift Holding), through which The Goldman Sachs Group Inc. (Goldman Sachs) and Kohlberg Kravis Roberts & Co. L.P. (KKR) held their shares in KION, placed their remaining KION shareholding of 18.8 per cent in February and March 2015. With this the strategic investors Goldman Sachs and KKR ceased to be shareholders. As part of the final placement, a block of shares equivalent to around 5.0 per cent was sold to Weichai Power Co. Ltd. in March. Weichai Power, the biggest single shareholder of the KION Group, with its stake now at 38.3 per cent, has undertaken not to acquire more than 49.9 per cent of KION shares between now and 28 June 2018 (as part of a standstill agreement).

KION GROUP AG launched another share buy-back programme on 10 September 2015 as part of its employee equity programme. In the period up to 30 September 2015, a total of 70,000 no-par-value shares (roughly 0.07 per cent of the share capital) had been purchased for this purpose. To do so, the KION Group AG used the authorisation granted at the Annual General Meeting on 13 June 2013.

The purchase of treasury shares left the proportion of shares held by KION GROUP AG unchanged at 0.2 per cent as at 31 December 2015. The free float accounted for 61.5 per cent at the end of the year. > DIAGRAM 002

KION shares predominantly recommended as a buy

17 brokerage houses published regular reports on KION Group in 2015. As at 31 December 2015, eleven analysts recommended KION shares as a buy and six rated them as neutral. The median target price specified for the shares was €48.50.

Dividend of €0.77 per share planned

The Executive Board and Supervisory Board of KION GROUP AG will propose a dividend of €0.77 per share to the Annual General Meeting on 12 May 2016. This equates to a dividend payout rate of around 35.0 per cent of net income. Earnings per share for 2015 came to €2.20. > TABLE 002

|

Share data |

002 |

||

|

|||

|

Closing price at the end of 2014 |

€31.74 |

||

|

High for 2015 |

€48.00 |

||

|

Low for 2015 |

€30.64 |

||

|

Closing price at the end of 2015 |

€46.02 |

||

|

Market capitalisation at the end of 2015 |

€4,551.4 million |

||

|

Performance in 2015 |

45.0% |

||

|

Average daily trading volume in 2015 (no. of shares) |

206.0 thousand |

||

|

Average daily trading volume in 2015 (€) |

€8.3 million |

||

|

Share capital |

€98,900,000 |

||

|

Number of shares |

98,900,000 |

||

|

Earnings per share for 2015 |

€2.20 |

||

|

Dividend per share for 2015* |

€0.77 |

||

|

Dividend payout rate* |

35% |

||

|

Total dividend payout* |

€76.0 million |

||

|

Equity ratio as at 31/12/2015 |

28.7% |

||

Refinancing and credit rating

The fixed-rate (6.75 per cent) tranche of the bond issued in February 2013, which has a volume of €450.0 million, was part of the Company’s funding structure in 2015 and repaid early and to the full extent on 15 February 2016. This bond as well as the remaining pre-IPO credit facility have been refinanced with a €1.5 billion credit facility reflecting investment-grade-style features. The new financing significantly reduces interest expenses and strongly improves KION’s flexibility to pursue its profitable growth. Two rating agencies publish corporate credit ratings on the KION Group and improved the ratings in April 2015. Rating agency Standard & Poor’s now rates the KION Group as BB+ with a stable outlook, while the rating from Moody’s is Ba2 with a positive outlook.