KION shares

Growing uncertainty impacts on equity markets

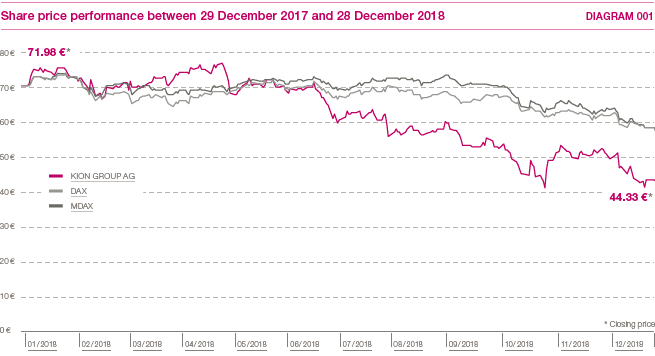

The trends in the global equity markets were primarily negative in 2018. After the markets were volatile in the first few months of the year, growing economic uncertainty took its toll on the stock exchanges mainly in the second half of the year, which resulted in a significant correction in global growth forecasts. Geopolitical tensions also had an impact. The ongoing trade dispute between the US and China and the prospect of the US government imposing further protectionist measures must also be mentioned in this context, as must the potential consequences of a hard Brexit, which became much more likely as the year progressed. Investor caution also rose on the back of growing concerns about the stability of the euro in the context of Italy’s expansionary fiscal policy. Further downward pressure resulted from the anticipated inversion of the yield curve in the bond markets, triggered by the US central bank’s interest-rate hikes. Over the year as a whole, the DAX fell by 18.3 per cent and the MDAX was down by 17.6 per cent.

KION shares affected by price losses

KION shares started 2018 with gains and achieved their highest price of the year of €78.88 on 20 April 2018. The volatile environment in the equity markets meant that it was not possible to maintain this upward trend in the subsequent months, and the price of the shares ended the year at €44.33, which was 38.4 per cent lower than their price at the close of 2017. At the end of 2018, market capitalisation stood at €5.2 billion, of which €2.9 billion was attributable to shares in free float. The average daily Xetra trading volume in 2018 was 295.7 thousand shares or €18.7 million, and thus below the prior year level (332.0 thousand shares or €22.0 million). > DIAGRAM 001

Record dividend agreed at the Annual General Meeting

The Annual General Meeting on 9 May 2018, at which around 80 per cent of the share capital was represented, approved the Supervisory Board and Executive Board’s proposals with a large majority. This included a 23.8 per cent increase in the dividend to €0.99 per share (2017: €0.80 per share). The total dividend payout was therefore up by more than a third at €116.8 million compared to the previous year (2017: €86.9 million). This equated to around 35 per cent of the net income for 2017 adjusted for the non-cash remeasurement of (net) deferred tax liabilities in connection with the lowering of the corporate income tax rate in the US. > TABLE 001

Basic information on KION shares |

001 |

ISIN |

DE000KGX8881 |

WKN |

KGX888 |

Bloomberg |

KGX:GR |

Reuters |

KGX.DE |

Share type |

No-par-value shares |

Index |

MDAX, MSCI World, STOXX Europe 600, FTSE EuroMid |

Reliable anchor shareholder, high free float

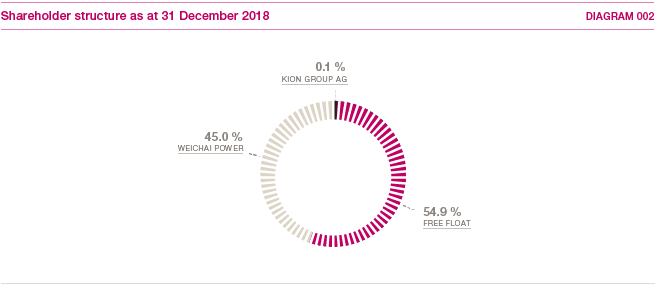

At the beginning of July 2018, Weichai Power Co., Ltd. announced that it was increasing its shareholding in KION GROUP AG from 43.3 per cent to 45.0 per cent. As at 31 December 2018, the free float accounted for around 54.9 per cent of the shares, while 0.1 per cent were treasury shares. Between 10 and 27 September 2018, KION GROUP AG repurchased a total of 66,000 shares (around 0.06 per cent of the share capital) for use in the KION Employee Equity Programme (KEEP). By 31 December 2018, a total of 38,691 shares had been purchased by staff (31 December 2017: 36,294 shares). The number of shares held in treasury stood at 165,558 as at the reporting date. > DIAGRAM 002

KION shares mainly recommended as a buy

As at 31 December 2018, 21 brokerage houses were following and reporting on the KION Group (31 December 2017: 21). Fifteen analysts recommended KION shares as a buy and six rated them as neutral. The median target price specified for the shares was €64.00 (31 December 2017: €75.00).

Dividend of €1.20 per share planned

The Executive Board and Supervisory Board of KION GROUP AG will propose a dividend of €1.20 per share (2017: €0.99) to the Annual General Meeting on 9 May 2019. Thus the total dividend payout amounts to €141.5 million, up by 21.3 per cent on the prior year. With earnings per share for 2018 of €3.39, this equates to a dividend payout rate of around 35 per cent. The prior year’s earnings per share, which is based on net income, was adjusted for the non-cash remeasurement of (net) deferred tax liabilities in connection with the lowering of the corporate income tax rate in the US. > TABLE 002

Share data |

002 |

||

|

|||

Closing price at the end of 2017 |

€71.98 |

||

High for 2017 |

€78.88 |

||

Low for 2017 |

€41.03 |

||

Closing price at the end of 2018 |

€44.33 |

||

Market capitalisation at the end of 2018 |

€5,234.9 million |

||

Performance in 2018 |

–38.4% |

||

Average daily XETRA-trading volume in 2018 (no. of shares) |

295.7 thousand |

||

Average daily XETRA-trading volume in 2018 (€) |

€18.7 million |

||

Share capital |

€118,090,000 |

||

Number of shares |

118,090,000 |

||

Earnings per share for 2018 |

€3.39 |

||

Dividend per share for 2018* |

€1.20 |

||

Dividend payout rate* |

35% |

||

Total dividend payout* |

€141.5 million |

||

Equity ratio as at 31/12/2018 |

25.5% |

||

Stable credit ratings

The KION Group is assigned credit ratings by two of the world’s leading independent rating agencies. Since January 2017, the Group has had an investment-grade long-term issuer rating from Fitch Ratings of BBB– with a stable outlook, while Standard & Poor’s has classified the Group as BB+ with a positive outlook since September 2017.