I. Remuneration system

The Supervisory Board of KION GROUP AG is responsible for setting and regularly reviewing the total pay of the individual members of the Executive Board. According to the rules of procedure for the Supervisory Board, the Executive Committee prepares all Supervisory Board resolutions pertaining to remuneration.

As recommended by the Executive Committee, the Supervisory Board approved the remuneration system by adopting resolutions at its meetings on 29 June 2016 and 28 September 2016, taking account of the requirements of stock company law and the DCGK.

The remuneration system described below for the members of the Executive Board of KION GROUP AG has applied since 1 January 2017 and was approved by the Annual General Meeting of KION GROUP AG on 11 May 2017 with a majority of 71.68 per cent. The Supervisory Board acknowledged these voting results from the 2017 Annual General Meeting and believes that it therefore has an ongoing duty to review the remuneration system.

The European Shareholder Rights’ Directive is to be implemented into German law in 2019, and we believe it will affect the changes being made to the German Corporate Governance Code. The Supervisory Board has therefore decided to review the remuneration system and level of remuneration for the members of the Executive Board of KION GROUP AG in 2019. To help with this review, KION will draw on the services of a remuneration consultancy that is independent of KION.

1) Essential features of the Executive Board remuneration system

The Supervisory Board based the level of remuneration for the members of our Executive Board on benchmark analyses of executive board pay in the MDAX. These analyses were conducted on behalf of the Supervisory Board by a consultancy that is independent of KION.

The Supervisory Board’s decision on changing the remuneration system was guided by KION GROUP AG’s positioning in the top quartile of the MDAX on the basis of its size, market position and total assets.

The remuneration of the Executive Board of KION GROUP AG is determined in accordance with the requirements of the German Stock Corporation Act and the DCGK and is focused on the Company’s long-term growth. It is determined so as to reflect the size and complexity of the KION Group, its business and financial situation, its performance and future prospects, the normal amount and structure of executive board remuneration in comparable companies and the internal salary structure. The Supervisory Board also takes into account the relationship between the Executive Board remuneration and the remuneration paid to senior managers and the German workforce of the Company as a whole, including changes over the course of time. To this end, the Supervisory Board has decided how the relevant benchmarks are to be defined. Other criteria used to determine remuneration are the individual responsibilities and personal performance of each member of the Executive Board. The financial and individual targets used in the Executive Board remuneration system are in line with the business strategy. The Supervisory Board regularly reviews the structure and appropriateness of Executive Board remuneration.

In doing so, the Supervisory Board focuses on the sustainability of the Company’s long-term performance and has therefore given a high weighting to the multiple-year variable remuneration components. The granting of a long-term incentive in the form of performance shares with a three-year term means that this component is linked to the share price and incentivises Executive Board members to ensure the Company performs well over the long term.

The total remuneration of the Executive Board comprises a non-performance-related salary, non-performance-related non-cash benefits, non-performance-related pension entitlements and performance-related (variable) remuneration. The system specifically allows for both positive and negative developments.

2) Upper limits on total remuneration

In accordance with the DCGK, remuneration is subject to upper limits on the amounts payable, both overall and also in terms of the variable components. The upper limit on the total cash remuneration to be paid, consisting of the fixed annual salary plus the one-year and multiple-year variable remuneration, equals roughly 1.7 times the target remuneration (2017: 1.7 times) – excluding the non-performance-related non-cash remuneration and other benefits paid in that financial year. Both the one-year and the multiple-year variable remuneration are capped at 200 per cent of the target value. The specific figures are shown in > TABLE 033.

3) Overview of the structure and parameters of Executive Board remuneration

Structure and parameters of Executive Board remuneration |

029 |

||||

Component |

Proportion of |

Measurement basis |

Range |

Basis and criteria |

Payment |

Basic remuneration |

32% – 37% |

Function, |

Fixed |

Specified in service contract |

Monthly instalments |

One-year variable remuneration (STI) |

20% – 22% |

KION Group’s overall success/ |

0% – 200% (full achievement = 100%) |

Achievement of financial targets for year (adjusted EBIT and free cash flow) and assessment of individual performance |

After adoption of annual financial statements |

Multiple-year variable remuneration (LTI) |

42% – 49% |

KION Group’s overall success/ |

0% – 200% (full achievement = 100%) + share price performance |

Achievement of ROCE target and relative total shareholder return compared with the MDAX and assessment of individual performance |

After expiry of three-year period and adoption of annual financial statements |

Pension plan |

|

Defined contribution pension entitlements and defined benefit entitlement |

Annual pension contribution / annual service cost |

Pension entitlement for retirement, insured event, early termination |

Capital / annuity |

Non-cash remuneration and additional benefits |

|

|

|

Specified in service contract |

|

The regular cash remuneration for a particular year, consisting of a non-performance-related fixed annual salary and performance-related (variable) remuneration, has a heavy emphasis on performance. If the targets set by the Supervisory Board are completely missed, only the fixed salary is paid. The cash remuneration is structured as follows in the event that the target value / maximum value is reached:

Target value:

32 to 37 per cent fixed annual salary

20 to 22 per cent one-year variable remuneration

42 to 49 per cent multiple-year variable remuneration

Maximum value:

19 to 23 per cent fixed annual salary

23 to 26 per cent one-year variable remuneration

52 to 58 per cent multiple-year variable remuneration

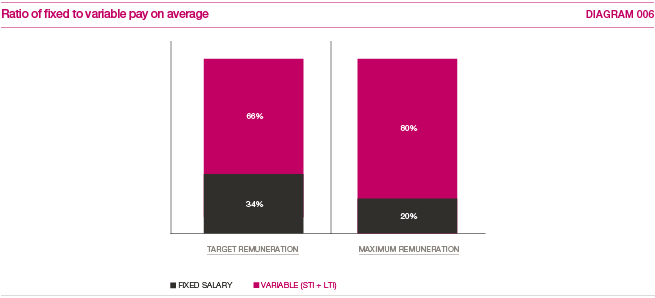

The variable components of the cash remuneration make up between 63 and 68 per cent of the target value and between 77 and 81 per cent of the maximum remuneration. In each case, multiple-year components account for two-thirds of the total.

Both the one-year and the multiple-year components are linked to key performance indicators used by the KION Group to measure its success. The KPIs relevant to one-year variable remuneration are adjusted earnings before interest and tax (EBIT) and free cash flow. The relevant KPIs for multiple-year variable remuneration are return on capital employed (ROCE) and relative total shareholder return (TSR).

The remuneration system is thus closely tied to the success of the Company and, with a high proportion of multiple-year variable remuneration, has a long-term focus aimed at promoting the KION Group’s growth.